Sanjiv Das - Publications

Summary on ScholarGPS.

TEACHING: NOTES/BOOKS

"Academic Life: (A)musings from the Ivory Tower"

PDF.

[A collection of essays and notes to myself about academic life.]

"Academic Life: (A)musings from the Ivory Tower"

PDF.

[A collection of essays and notes to myself about academic life.]

"Natural Language Processing" (web book)

Read here.

"Natural Language Processing" (web book)

Read here.

"Data Science: Theories, Models, Algorithms, and Analytics" (web book -- work in progress)

Read here.

Real-time web version (using R)

Data for the examples in the book

Real-time web version (WIP: using Python and R)

"Data Science: Theories, Models, Algorithms, and Analytics" (web book -- work in progress)

Read here.

Real-time web version (using R)

Data for the examples in the book

Real-time web version (WIP: using Python and R)

"Derivatives: Principles and Practice" (1st edition 2010, 2nd edition 2016),

(Rangarajan Sundaram and Sanjiv Das), McGraw Hill.

[Amazon]

[BarnesNoble]

"Derivatives: Principles and Practice" (1st edition 2010, 2nd edition 2016),

(Rangarajan Sundaram and Sanjiv Das), McGraw Hill.

[Amazon]

[BarnesNoble]

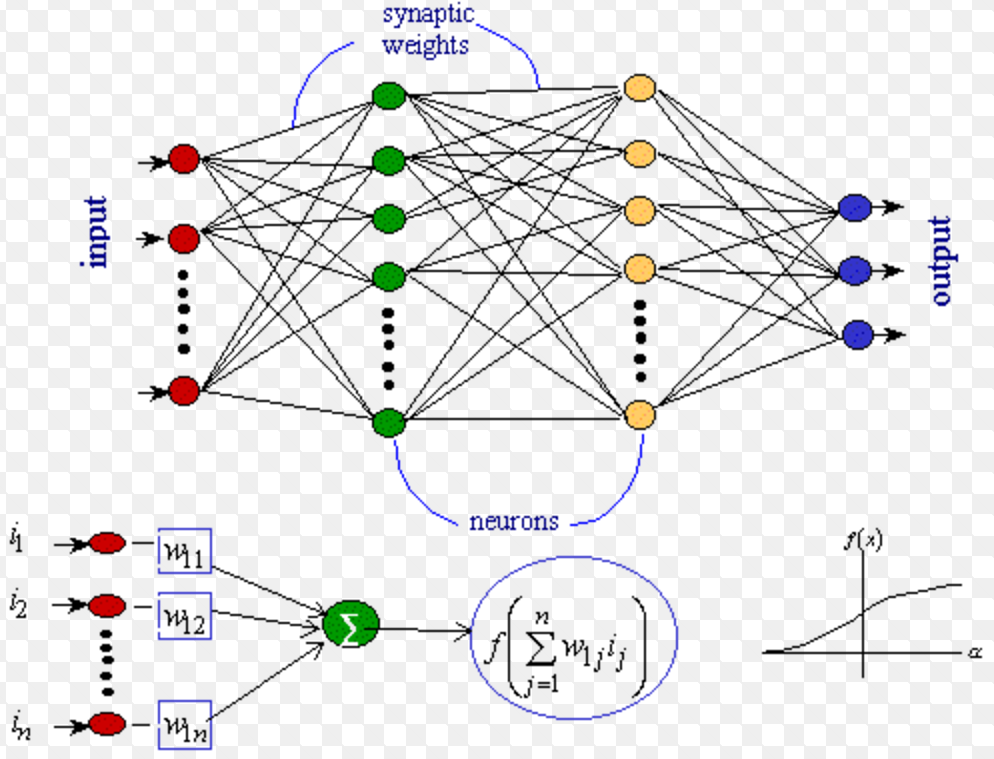

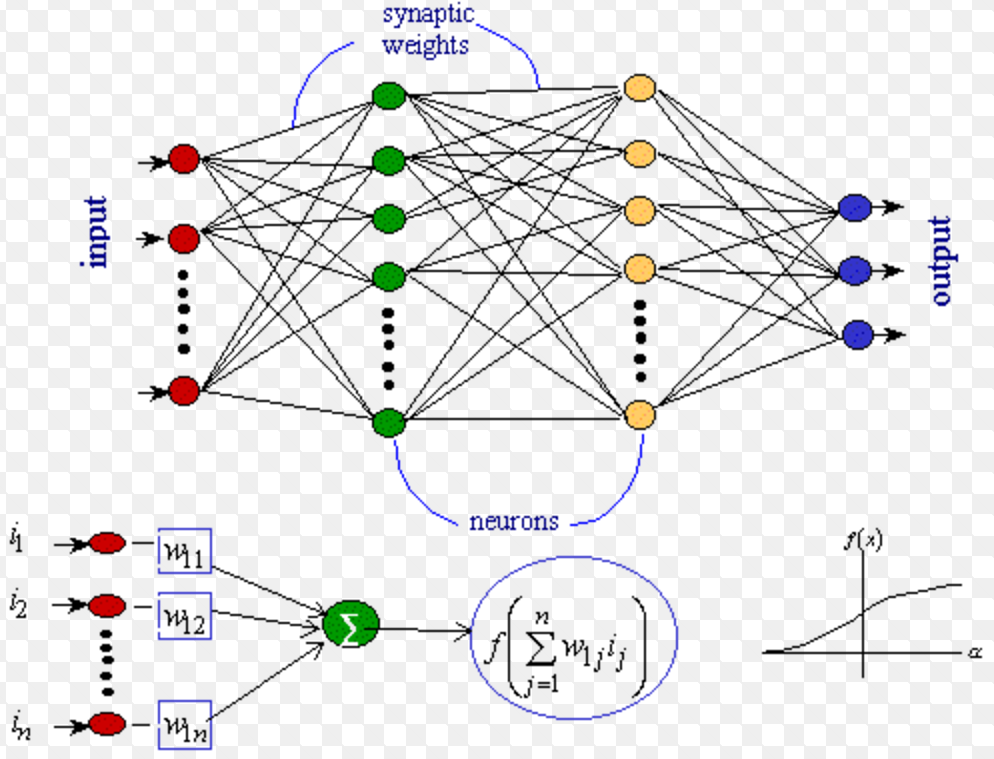

"Deep Learning" (web book with Subir Varma -- work in progress)

Real-time web version

Real-time web version (using Python and R)

"Deep Learning" (web book with Subir Varma -- work in progress)

Real-time web version

Real-time web version (using Python and R)

REFEREED JOURNAL/CONFERENCE PUBLICATIONS

MACHINE LEARNING / NLP / FINTECH / BIG DATA

"Yield Curve Forecasting with Machine Learning and Econometrics: A Comparative Analysis" (2025), (with Aman Singh, Tokunbo Ogunfunmi).

Journal of Investment Management, v23(4), 37-58.

"Yield Curve Forecasting with Machine Learning and Econometrics: A Comparative Analysis" (2025), (with Aman Singh, Tokunbo Ogunfunmi).

Journal of Investment Management, v23(4), 37-58.

"Reinforcement learning for Multiple Goals in Goals-Based Wealth Management" (2024), Proceedings of the AIxB 2024: IEEE International Conference on AI x Business, [AIxB], (with Sukrit Mittal, Daniel Ostrov, Anand Radhakrishnan, Deep Srivastav, Hungjen Wang), [PDF].

[Reinforcement learning performs as well as dynamic programming with minimal training for goals-based wealth management problems.

"Reinforcement learning for Multiple Goals in Goals-Based Wealth Management" (2024), Proceedings of the AIxB 2024: IEEE International Conference on AI x Business, [AIxB], (with Sukrit Mittal, Daniel Ostrov, Anand Radhakrishnan, Deep Srivastav, Hungjen Wang), [PDF].

[Reinforcement learning performs as well as dynamic programming with minimal training for goals-based wealth management problems.

"Credit Risk Modeling with Graph Machine Learning" 2023,

(with Xin Huang, Soji Adeshina, Patrick Yang, Leonardo Bachega),

INFORMS Journal on Data Science, v2(2), 197-217.

[PDF].

"Credit Risk Modeling with Graph Machine Learning" 2023,

(with Xin Huang, Soji Adeshina, Patrick Yang, Leonardo Bachega),

INFORMS Journal on Data Science, v2(2), 197-217.

[PDF].

[Using SEC filing text to construct a corporate graph and improve on tabular credit

rating algorithms using graph machine learning.]

"Algorithmic Fairness", 2023, (with Richard Stanton, Nancy Wallace), Annual Review of Financial Economics, v15, 565-593.

[JOURNAL].

"Algorithmic Fairness", 2023, (with Richard Stanton, Nancy Wallace), Annual Review of Financial Economics, v15, 565-593.

[JOURNAL].

[A review of algorithmic bias in finance, with metrics and an application to mortgage lending.]

"Utility-Preserving Privacy-Enabled Speech Embeddings for Emotion Detection" (with Chandrashekhar Lavania, Xin Huang, Kyu Han), proceedings of Interspeech 2023, 3612-3616, doi: 10.21437/Interspeech.2023-1075.

[CONF].

"Utility-Preserving Privacy-Enabled Speech Embeddings for Emotion Detection" (with Chandrashekhar Lavania, Xin Huang, Kyu Han), proceedings of Interspeech 2023, 3612-3616, doi: 10.21437/Interspeech.2023-1075.

[CONF].

[A novel embedding shuffling scheme to prepare speech embeddings that may be used for emotion detection and other tasks but suppresses speaker identification to promote privacy.]

"A System for Analyzing Human Capability at Scale" (2023), (with Daniel Zhu, Dave Ulrich, Norm Smallwood). Accepted at IntelliSys 2023

[PDF].

[Conf Volume]

[Conf Publication]

[Conf Interview]

"A System for Analyzing Human Capability at Scale" (2023), (with Daniel Zhu, Dave Ulrich, Norm Smallwood). Accepted at IntelliSys 2023

[PDF].

[Conf Volume]

[Conf Publication]

[Conf Interview]

[Machine learning to build a prototype system to analyze HC using SEC filings applied to 5,760 companies. Creates a dashboard for each firm on the quantity of reporting over four dimensions of HC: talent, leadership, organization, and human resources operations.]

"Digitization and data frames for card index records" 2023, (with Someswar Amujala and Angela Vossmeyer),

Explorations in Economic History, v87 (January), 101469,

[Paper].

"Digitization and data frames for card index records" 2023, (with Someswar Amujala and Angela Vossmeyer),

Explorations in Economic History, v87 (January), 101469,

[Paper].

[A machine learning pipeline to construct a dataset of handwritten and typewritten loan cards from the Great Depression.]

"Intelligent Probabilistic Forecasts of VIX and its Volatility using Machine Learning Methods," (2022), (with Aerambamoorthy Thavaneswaran, You Liang, Ruppa K. Thulasiram, Janakumar Bhanushali), Proceedings of

IEEE Computational Intelligence for Financial Engineering and Economics, Helsinki.

[IEEE].

[DOI].

"Intelligent Probabilistic Forecasts of VIX and its Volatility using Machine Learning Methods," (2022), (with Aerambamoorthy Thavaneswaran, You Liang, Ruppa K. Thulasiram, Janakumar Bhanushali), Proceedings of

IEEE Computational Intelligence for Financial Engineering and Economics, Helsinki.

[IEEE].

[DOI].

[Machine learning for better forecasts of the level and volatility of the VIX.]

"FinLex: An Effective Use of Word Embeddings for Financial Lexicon Generation'' 2021, (with Michele Donini, Muhammad Bilal Zafar, John He, Krishnaram Kenthapadi),

Journal of Finance and Data Science, v8 (November), 1-11.

[DOI].

[WEB].

"FinLex: An Effective Use of Word Embeddings for Financial Lexicon Generation'' 2021, (with Michele Donini, Muhammad Bilal Zafar, John He, Krishnaram Kenthapadi),

Journal of Finance and Data Science, v8 (November), 1-11.

[DOI].

[WEB].

[A simple algorithm to generate contextual words lists for

NLP scoring from seed words.]

-

"Fairness measures for machine learning in finance" 2021 (with Michele Donini, Jason

Gelman, Kevin Haas, Mila Hardt, Jared Katzman, Krishnaram Kenthapadi, Pedro Larroy, Pinar

Yilmaz, Bilal Zafar ), Journal of Financial Data Science, v3(4), 33-64.

[JFDS].

"Fairness measures for machine learning in finance" 2021 (with Michele Donini, Jason

Gelman, Kevin Haas, Mila Hardt, Jared Katzman, Krishnaram Kenthapadi, Pedro Larroy, Pinar

Yilmaz, Bilal Zafar ), Journal of Financial Data Science, v3(4), 33-64.

[JFDS].

[A machine learning pipeline for fairness-aware machine learning (FAML) in finance that encompasses metrics for fairness (and accuracy).]

-

"Context, Language Modeling, and Multimodal Data in Finance" 2021 (with Connor Goggins,

John He, George Karypis, Sandeep Krishnamurthy, Mitali Mahajan, Nagpurnanand Prabhala,

Dylan Slack, Rob van Dusen, Shenghua Yue, Sheng Zha and Shuai Zheng), Journal of

Financial Data Science, v3(3), 52-66.

[JFDS].

"Context, Language Modeling, and Multimodal Data in Finance" 2021 (with Connor Goggins,

John He, George Karypis, Sandeep Krishnamurthy, Mitali Mahajan, Nagpurnanand Prabhala,

Dylan Slack, Rob van Dusen, Shenghua Yue, Sheng Zha and Shuai Zheng), Journal of

Financial Data Science, v3(3), 52-66.

[JFDS].

[Multimodal (long text, numerical, and categorical) data for financial machine

learning. Showcases a financial language model pre-trained on Wiki text

and SEC filings.]

"Amazon SageMaker Clarify: Machine Learning Bias Detection and Explainability in the Cloud'' 2021 (with M. Hardt, X. Chen, X. Cheng, M. Donini, J. Gelman, S. Gollaprolu, J. He, P. Larroy, X. Liu, N. McCarthy, A. Rathi, S. Rees, A. Siva, K. Vasist, P. Yilmaz, B. Zafar, K. Haas, T. Hill, K. Kenthapadi, Krishnaram).

KDD '21, Research Track, August, 2974-2983.

[KDD]

"Amazon SageMaker Clarify: Machine Learning Bias Detection and Explainability in the Cloud'' 2021 (with M. Hardt, X. Chen, X. Cheng, M. Donini, J. Gelman, S. Gollaprolu, J. He, P. Larroy, X. Liu, N. McCarthy, A. Rathi, S. Rees, A. Siva, K. Vasist, P. Yilmaz, B. Zafar, K. Haas, T. Hill, K. Kenthapadi, Krishnaram).

KDD '21, Research Track, August, 2974-2983.

[KDD]

[The paper presents how biases are detected and explainability

are provided in an ML pipeline.]

"Multimodal Machine Learning for Credit Modeling", 2021 (with Cuong Nguyen, John He, Shenghua Yue, Vinay Hanumaiah, Xavier Ragot, Li Zhang).

The 1st IEEE International Workshop on Dynamic Data Science & Big Data Analytics in Finance,

([DDS-BDAF 2021]).

[IEEE].

"Multimodal Machine Learning for Credit Modeling", 2021 (with Cuong Nguyen, John He, Shenghua Yue, Vinay Hanumaiah, Xavier Ragot, Li Zhang).

The 1st IEEE International Workshop on Dynamic Data Science & Big Data Analytics in Finance,

([DDS-BDAF 2021]).

[IEEE].

[Multimodal machine learning is used to enhance tabular

ML with text data in an ensemble model.]

"On the Lack of Robustness of Neural Text Classifiers", 2021

(with Bilal Zafar, Michele Donini, Dylan Slack, Cedric Archambeau,

Krishnaram Kenthapadi).

The Joint Conference of the 59th Annual Meeting of the Association

for Computational Linguistics and the 11th International Joint

Conference on Natural Language Processing,

([ACL-IJCNLP 2021]),

August, 3730-3740.

[ACL]

"On the Lack of Robustness of Neural Text Classifiers", 2021

(with Bilal Zafar, Michele Donini, Dylan Slack, Cedric Archambeau,

Krishnaram Kenthapadi).

The Joint Conference of the 59th Annual Meeting of the Association

for Computational Linguistics and the 11th International Joint

Conference on Natural Language Processing,

([ACL-IJCNLP 2021]),

August, 3730-3740.

[ACL]

[Develops metrics and tests whether feature importance

is stable across NLP classifiers.]

"The Future of FinTech", 2019, Financial Management, Special Issue on Fintech, v48, 981-1007. DOI: 10.1111/�ma.12297.

[PDF].

"The Future of FinTech", 2019, Financial Management, Special Issue on Fintech, v48, 981-1007. DOI: 10.1111/�ma.12297.

[PDF].

[A survery and prognostication on the opportunities and pitfalls of fintech, with a suggested taxonomy.]

-

"Zero-Revelation RegTech: Detecting Risk through

Linguistic Analysis of Corporate Emails and News", (2019),

(with Seoyoung Kim and Bhushan Kothari),

Journal of Financial Data Science, 2019, v1(2), 8-34.

Summary for the Columbia Law School blog:

[Paper].

"Zero-Revelation RegTech: Detecting Risk through

Linguistic Analysis of Corporate Emails and News", (2019),

(with Seoyoung Kim and Bhushan Kothari),

Journal of Financial Data Science, 2019, v1(2), 8-34.

Summary for the Columbia Law School blog:

[Paper].

[How a software system might detect early firm distress through

an anonymous reading of emails.]

"Research Challenges in Financial Data Modeling and Analysis" 2017,

(with Lewis Alexander, Zachary Ives, H.V. Jagadish, and Claire Monteleoni).

Big Data, v5(3), 177-188.

[Paper].

"Research Challenges in Financial Data Modeling and Analysis" 2017,

(with Lewis Alexander, Zachary Ives, H.V. Jagadish, and Claire Monteleoni).

Big Data, v5(3), 177-188.

[Paper].

[The paper reviews the significant research challenges to be addressed, and progress made, in the cleaning, transformation, integration, modeling, and analytics of Big Data sources for finance. ]

"Text and Context: Language Analytics for Finance", (2014),

Foundations and Trends in Finance, v8(3), 145-260.

[Monograph].

[PDF].

"Text and Context: Language Analytics for Finance", (2014),

Foundations and Trends in Finance, v8(3), 145-260.

[Monograph].

[PDF].

[A comprehensive survey of comcepts, tools, techniques, and empirical

literature on textual processing in finance.]

"Extracting, Linking and Integrating Data from Public Sources: A Financial Case Study,"

(2011), (with Douglas Burdick, Mauricio A. Hernandez, Howard Ho, Georgia Koutrika,

Rajasekar Krishnamurthy, Lucian Popa, Ioana Stanoi, Shivakumar Vaithyanathan),

IEEE Data Engineering Bulletin, 34(3), 60-67.

[Paper].

"Extracting, Linking and Integrating Data from Public Sources: A Financial Case Study,"

(2011), (with Douglas Burdick, Mauricio A. Hernandez, Howard Ho, Georgia Koutrika,

Rajasekar Krishnamurthy, Lucian Popa, Ioana Stanoi, Shivakumar Vaithyanathan),

IEEE Data Engineering Bulletin, 34(3), 60-67.

[Paper].

[Financial forensics using big financial data from public sources.]

"Yahoo for Amazon! Sentiment Extraction from Small Talk on the Web,"

(with Mike Chen), (2007), Management Science, v53, 1375-1388.

[JSTOR].

"Yahoo for Amazon! Sentiment Extraction from Small Talk on the Web,"

(with Mike Chen), (2007), Management Science, v53, 1375-1388.

[JSTOR].

[A methodology for parsing internet stock chat to develop a sentiment index. Assesses

whether small traders opinions contain information not in prices. ]

"eInformation: A Clinical Study of Investor Discussion and Sentiment,"

(with Asis Martinez-Jerez and Peter Tufano), 2005,

Financial Management, v34(5), 103-137.

[Paper].

"eInformation: A Clinical Study of Investor Discussion and Sentiment,"

(with Asis Martinez-Jerez and Peter Tufano), 2005,

Financial Management, v34(5), 103-137.

[Paper].

[Examines the interaction of chat room information and news. ]

"Multiple Regression and Machine Learning," (2018), (with Richard A. DeFusco,

Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle), CFA Institute,

reading 8 in the 2019 CFA Program Curriculum for CFA Level II.

"Multiple Regression and Machine Learning," (2018), (with Richard A. DeFusco,

Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle), CFA Institute,

reading 8 in the 2019 CFA Program Curriculum for CFA Level II.

"Machine Learning in Finance: The Case of Deep Learning for Option Pricing" (2017),

(with Robbie Culkin).

Journal of Investment Management, v15(4), 92-100.

"Machine Learning in Finance: The Case of Deep Learning for Option Pricing" (2017),

(with Robbie Culkin).

Journal of Investment Management, v15(4), 92-100.

"Big Data's Big Muscle," (2016),

Finance and Development (IMF), September, 14(2), 26-28.

"Big Data's Big Muscle," (2016),

Finance and Development (IMF), September, 14(2), 26-28.

[Economics in the machine age.]

"News Analytics: Framework, Techniques and Metrics," The Handbook of News Analytics in Finance, May 2011, John Wiley & Sons, U.K.

"News Analytics: Framework, Techniques and Metrics," The Handbook of News Analytics in Finance, May 2011, John Wiley & Sons, U.K.

"The Finance Web: Internet Information and Markets," (2010),

IEEE Intelligent Systems, 25(2), Mar/Apr, 74--78.

"The Finance Web: Internet Information and Markets," (2010),

IEEE Intelligent Systems, 25(2), Mar/Apr, 74--78.

"Financial Applications with Parallel R," (2009),

(with Brian Granger), Journal of Investment Management, 7(4), 66-77

"Financial Applications with Parallel R," (2009),

(with Brian Granger), Journal of Investment Management, 7(4), 66-77

"Multiple-Core Processors for Finance Applications," 2006,

Journal of Investment Management, v4(2), 76-81.

"Multiple-Core Processors for Finance Applications," 2006,

Journal of Investment Management, v4(2), 76-81.

PORTFOLIO OPTIMIZATION / BEHAVIORAL FINANCE / WEALTH MANAGEMENT

"Augmenting the Funded Ratio: New Metrics for Liability Based Plans"

(with Dan Ostrov, Anand Radhakrishnan, Deep Srivastav, Wylie Tollette),

forthcoming Journal of Pension Economics and Finance

[PDF].

"Augmenting the Funded Ratio: New Metrics for Liability Based Plans"

(with Dan Ostrov, Anand Radhakrishnan, Deep Srivastav, Wylie Tollette),

forthcoming Journal of Pension Economics and Finance

[PDF].

"Markowitz Wealth Management to Pension Plans" 2025 (transcript of a talk given in honor of Harry Markowitz)

Journal of Investment Management, v25(2)

[Journal]

"Markowitz Wealth Management to Pension Plans" 2025 (transcript of a talk given in honor of Harry Markowitz)

Journal of Investment Management, v25(2)

[Journal]

"Unrealistic Expectations: The Futility of Precisely Estimating a Stock’s Expected Return" 2024 (with Daniel Ostrov), Journal of Investment Management, v22(1), 58-64.

[PDF].

"Unrealistic Expectations: The Futility of Precisely Estimating a Stock’s Expected Return" 2024 (with Daniel Ostrov), Journal of Investment Management, v22(1), 58-64.

[PDF].

[Revisits the difficulty of estimating mean returns for portfolio optimization. We need 400 years of data to achieve reasonable accuracy.]

"Lifestyle, Longevity, and Legacy Risks with Annuities in Retirement Portfolio Decumulation" 2023,

(with Daniel Ostrov, Anand Radhakrishnan, Deep Srivastav), Journal of Wealth Management, v26(2), 9-34.

[PDF].

"Lifestyle, Longevity, and Legacy Risks with Annuities in Retirement Portfolio Decumulation" 2023,

(with Daniel Ostrov, Anand Radhakrishnan, Deep Srivastav), Journal of Wealth Management, v26(2), 9-34.

[PDF].

[Examines the tradeoff between consumption, leaving a legacy, modulated by life expectancy. Should we ever buy annuities?]

"Efficient Goal Probabilities: A New Frontier" 2023, (with Daniel Ostrov, Anand Radhakrishnan, Deep Srivastav), Journal of Investment Management, v21(3).

[PDF].

"Efficient Goal Probabilities: A New Frontier" 2023, (with Daniel Ostrov, Anand Radhakrishnan, Deep Srivastav), Journal of Investment Management, v21(3).

[PDF].

[How to generate Pareto-optimal goal probability frontiers in goals-based wealth management.]

"The Role of Options in Goals-Based Wealth Management" 2023, (with Greg Ross), Journal of Investment Management, v21(1).

[PDF].

"The Role of Options in Goals-Based Wealth Management" 2023, (with Greg Ross), Journal of Investment Management, v21(1).

[PDF].

[Improving goal based outcome trading strategies using options.]

"Optimal Goals-Based Investment Strategies For Switching Between Bull and Bear Markets," (2022), (with Daniel Ostrov, Aviva Casanova, Anand Radhakrishnan, Deep Srivastav),

Journal of Wealth Management, v24(4), 8-36.

[PDF].

[JWM]

"Optimal Goals-Based Investment Strategies For Switching Between Bull and Bear Markets," (2022), (with Daniel Ostrov, Aviva Casanova, Anand Radhakrishnan, Deep Srivastav),

Journal of Wealth Management, v24(4), 8-36.

[PDF].

[JWM]

[Goals-based wealth management with regime changes. Unless regime cognizance is high, a single regime approach may be better.]

"Combining Investment and Tax Strategies for Optimizing Lifetime Solvency under Uncertain Returns and Mortality" (2021), (with Dan Ostrov, Aviva Casanova, Anand Radhakrishnan, Deep Srivastav), Journal of Risk and Financial Management, v14(7), 285.

[Paper].

"Combining Investment and Tax Strategies for Optimizing Lifetime Solvency under Uncertain Returns and Mortality" (2021), (with Dan Ostrov, Aviva Casanova, Anand Radhakrishnan, Deep Srivastav), Journal of Risk and Financial Management, v14(7), 285.

[Paper].

[Goals-based wealth management combined with tax optimization

across taxable and tax-deductible accounts, fully accounting for

longevity risk.]

"Dynamic Optimization for Multi-Goals Wealth Management." 2021 (with Dan Ostrov, Anand Radhakrishnan, Deep Srivastav),

Journal of Banking and Finance, v140, 106192.

[JBF],

[DOI].

[PDF].

"Dynamic Optimization for Multi-Goals Wealth Management." 2021 (with Dan Ostrov, Anand Radhakrishnan, Deep Srivastav),

Journal of Banking and Finance, v140, 106192.

[JBF],

[DOI].

[PDF].

[Goals-based wealth management with multiple, concurrent, and

partial goals.]

"Dynamic Goals-Based Wealth Management using Reinforcement Learning." 2020,

(with Subir Varma), Journal of Investment Management, Special Issue on Machine Learning in Investment Management, v18(2), 37-56.

[PDF].

"Dynamic Goals-Based Wealth Management using Reinforcement Learning." 2020,

(with Subir Varma), Journal of Investment Management, Special Issue on Machine Learning in Investment Management, v18(2), 37-56.

[PDF].

[Goals-based wealth management implemented with reinforcement learning, as well as a gentle introduction to reinforcement learning for finance.]

"Dynamic Portfolio Allocation in Goals-Based Wealth Management", (2020),

(with Dan Ostrov, Anand Radhakrishnan, and Deep Srivastav),

Computational Management Science, v17, June, 613-640, DOI:10.1007/s10287-019-00351-7.

[PDF].

"Dynamic Portfolio Allocation in Goals-Based Wealth Management", (2020),

(with Dan Ostrov, Anand Radhakrishnan, and Deep Srivastav),

Computational Management Science, v17, June, 613-640, DOI:10.1007/s10287-019-00351-7.

[PDF].

[Goals-based wealth management implemented with dynamic programming

outperforms target date funds.]

"A New Approach to Goals-Based Wealth Management" (2018),

(with Dan Ostrov, Anand Radhakrishnan, Deep Srivastav),

Journal of Investment Management, v16(3), 1-27.

[Paper].

"A New Approach to Goals-Based Wealth Management" (2018),

(with Dan Ostrov, Anand Radhakrishnan, Deep Srivastav),

Journal of Investment Management, v16(3), 1-27.

[Paper].

[New framework and mathematics for implementing goals-based wealth management,

where risk is redefined as the likelihood of not meeting one's goals. Winner of the Harry Markowitz Award for Best Paper.]

"Options and Structured Products in Behavioral Portfolios," (with Meir Statman), (2013),

Journal of Economic Dynamics and Control, 37(1), 137-153.

[Paper].

"Options and Structured Products in Behavioral Portfolios," (with Meir Statman), (2013),

Journal of Economic Dynamics and Control, 37(1), 137-153.

[Paper].

[Explores the roles in behavioral portfolios of option collars, capital guaranteed notes,

and barrier range notes, in the presence of fat-tailed outcomes using copulas.

]

"Portfolio

Optimization with Mental Accounts," (2010), (with Harry Markowitz, Jonathan

Scheid, and Meir Statman), Journal of Financial and Quantitative

Analysis, v45(2), 311-334.

[Paper].

[Correction of typo in the paper].

"Portfolio

Optimization with Mental Accounts," (2010), (with Harry Markowitz, Jonathan

Scheid, and Meir Statman), Journal of Financial and Quantitative

Analysis, v45(2), 311-334.

[Paper].

[Correction of typo in the paper].

[Mean-variance optimization is reconciled with behavioral porfolio theory. Mental

accounts optimization leads to better aggregate portfolios.]

"The Long and Short of it: Why are stocks with shorter run-lengths preferred?" (2010), (with Priya Raghubir), Journal of Consumer Research. 36(6), 964-982.

[Non-technical summary].

[JSTOR].

"The Long and Short of it: Why are stocks with shorter run-lengths preferred?" (2010), (with Priya Raghubir), Journal of Consumer Research. 36(6), 964-982.

[Non-technical summary].

[JSTOR].

[People responding to stock charts are systematically biased against stocks with longer run lengths, even if these stocks are no riskier than those with shorter runs.]

"Fee

Speech: Signaling, Risk-sharing and the Impact of Fee Structures on

Investor Welfare,'' (with Rangarajan Sundaram), 2002, Review of

Financial Studies, v15, 1465-1497.

[Paper].

"Fee

Speech: Signaling, Risk-sharing and the Impact of Fee Structures on

Investor Welfare,'' (with Rangarajan Sundaram), 2002, Review of

Financial Studies, v15, 1465-1497.

[Paper].

[Compares fulcrum vs incentive fees structures from the standpoint of

investor welfare. Contrary to regulatory intuition, incentive structures

are often optimal.]

"The Psychology of Financial Decision Making: A Case

for Theory-Driven Experimental Enquiry,''

1999, (with Priya Raghubir),

Financial Analyst's Journal, Nov-Dec 1999, v55(6), 56-79.

[Paper].

"The Psychology of Financial Decision Making: A Case

for Theory-Driven Experimental Enquiry,''

1999, (with Priya Raghubir),

Financial Analyst's Journal, Nov-Dec 1999, v55(6), 56-79.

[Paper].

[Surveys the anomalies literature in Finance and shows how experimental

studies may be used to disentangle competing hypotheses for the same anomaly.]

"A Theory of Optimal Timing and Selectivity,''

(with George Chacko), 1999, Journal of

Economic Dynamics and Control, v23(7), 929-966.

[Paper].

"A Theory of Optimal Timing and Selectivity,''

(with George Chacko), 1999, Journal of

Economic Dynamics and Control, v23(7), 929-966.

[Paper].

[Dynamic optimal portfolio choice model for determining optimal effort

allocation to timing and stock selection in asset allocation.]

"Efficient Rebalancing of Taxable Portfolios" (2017),

(with Dan Ostrov, Dennis Ding, Vincent Newell), Journal of Investment Strategies, v7(1), 1-40.

[SLIDES RFinance].

[SLIDES JOIM].

"Efficient Rebalancing of Taxable Portfolios" (2017),

(with Dan Ostrov, Dennis Ding, Vincent Newell), Journal of Investment Strategies, v7(1), 1-40.

[SLIDES RFinance].

[SLIDES JOIM].

[An efficient numerical algorithm for tax-efficient portfolio rebalancing while

carrying the entire cost basis, for long horizons.]

"Coming up Short: Managing Underfunded Portfolios in an LDI-ES Framework" (2014),

(with Seoyoung Kim and Meir Statman),

Journal of Portfolio Management, 41(1), 95-108.

"Coming up Short: Managing Underfunded Portfolios in an LDI-ES Framework" (2014),

(with Seoyoung Kim and Meir Statman),

Journal of Portfolio Management, 41(1), 95-108.

[Provides a new definition of underfunded portfolios, and compares four remedies for underfunding.]

"A

Numerical Algorithm for Consumption/Investment Problems," (with Rangarajan

Sundaram), 2002, International Journal of Intelligent

Systems in Accounting, Finance and Management, (Special

Issue on Computational Methods in Economics and Finance),

December, 55-69.

"A

Numerical Algorithm for Consumption/Investment Problems," (with Rangarajan

Sundaram), 2002, International Journal of Intelligent

Systems in Accounting, Finance and Management, (Special

Issue on Computational Methods in Economics and Finance),

December, 55-69.

[A simple regression approach to solving optimal consumption

and portfolio problems with diffusions and jumps.]

"How Diversified are Internationally Diversified Portfolios:

Time-Variation in the Covariances between International Returns,"

1998, (with Raman Uppal), Canadian Investment Review, Spring, 7-11.

"How Diversified are Internationally Diversified Portfolios:

Time-Variation in the Covariances between International Returns,"

1998, (with Raman Uppal), Canadian Investment Review, Spring, 7-11.

[Internation portfolio risk has systemic components. ]

``Risk, Reward, and Beyond: On the Behavioral Sensitivities of Mean-Variance Efficient Portfolios,''

(2018), (with Jurgen Vandenbroucke), Journal of Investment Management, 16(4).

``Risk, Reward, and Beyond: On the Behavioral Sensitivities of Mean-Variance Efficient Portfolios,''

(2018), (with Jurgen Vandenbroucke), Journal of Investment Management, 16(4).

"Portfolios for Investors Who Want to Reach Their Goals While Staying on the Mean-Variance Efficient Frontier," (2011),

(with Harry Markowitz, Jonathan Scheid, and Meir Statman),

Journal of Wealth Management, Fall, 14(2), 25-31.

"Portfolios for Investors Who Want to Reach Their Goals While Staying on the Mean-Variance Efficient Frontier," (2011),

(with Harry Markowitz, Jonathan Scheid, and Meir Statman),

Journal of Wealth Management, Fall, 14(2), 25-31.

[A framework for goal driven mental accounting and behavioral portfolio allocation that extends mean-variance portfolios.]

"The Regulation of Fee Structures in Mutual Funds: A Theoretical Analysis,''

(with Rangarajan Sundaram), 1998, NBER WP No 6639, in the

Courant Institute of Mathematical Sciences, special volume on

Quantitative Analysis in Financial Markets, Volume III, 2001.

"The Regulation of Fee Structures in Mutual Funds: A Theoretical Analysis,''

(with Rangarajan Sundaram), 1998, NBER WP No 6639, in the

Courant Institute of Mathematical Sciences, special volume on

Quantitative Analysis in Financial Markets, Volume III, 2001.

CORRELATED SYSTEMS: NETWORKS / SYSTEMIC RISK / BANKING / STRUCTURED FINANCE

"Banking Networks, Systemic Risk, and the Credit Cycle in Emerging Markets" (2022), (with Madhu Kalimipalli and Subhankar Nayak), Journal of International Financial Markets, Institutions & Money, v80 (september), 101633,

[Paper]

"Banking Networks, Systemic Risk, and the Credit Cycle in Emerging Markets" (2022), (with Madhu Kalimipalli and Subhankar Nayak), Journal of International Financial Markets, Institutions & Money, v80 (september), 101633,

[Paper]

[Systemic risk in emerging markets using networks.]

"Bank Regulation, Network Topology, and Systemic Risk: Evidence from the Great Depression" (2021), (with Kris Mitchener and Angela Vossmeyer).

Journal of Money, Credit and Banking, v54(5), 1261-1312.

[PDF].

[JMCB].

Profiled on [VOX]

"Bank Regulation, Network Topology, and Systemic Risk: Evidence from the Great Depression" (2021), (with Kris Mitchener and Angela Vossmeyer).

Journal of Money, Credit and Banking, v54(5), 1261-1312.

[PDF].

[JMCB].

Profiled on [VOX]

[Network topology mattered in the Great Depression and graph theory may be used to improve bank failure prediction.]

-

"Dynamic Systemic Risk: Networks in Data Science", 2019, (with Seoyoung Kim

and Dan Ostrov), Journal of Financial Data Science, v1(1), 141-158.

[Paper].

"Dynamic Systemic Risk: Networks in Data Science", 2019, (with Seoyoung Kim

and Dan Ostrov), Journal of Financial Data Science, v1(1), 141-158.

[Paper].

[Extending the Merton default risk model to systemic risk on networks.]

"Matrix Metrics: Network-Based Systemic Risk Scoring", (2016).

Journal of Alternative Investments, Special Issue on Systemic Risk, v18(4), 33-51.

[Paper].

"Matrix Metrics: Network-Based Systemic Risk Scoring", (2016).

Journal of Alternative Investments, Special Issue on Systemic Risk, v18(4), 33-51.

[Paper].

[A new approach to identifying system-wide financial risk, SIFIs, and several other measures of systemic risk. This paper won the First Prize in the MIT-CFP competition 2016 for the best paper on SIFIs (systemically important financial institutions).

It also won the best paper award at

the R Finance conference, Chicago 2015. ]

"Systemic Risk and International Portfolio Choice,"

(with Raman Uppal), 2004, Journal of Finance, v59(6), 2809-2834.

[JSTOR].

"Systemic Risk and International Portfolio Choice,"

(with Raman Uppal), 2004, Journal of Finance, v59(6), 2809-2834.

[JSTOR].

[A model for portfolio optimization with systemic risk.

The loss resulting from diminished diversification is small, while

that from holding very highly levered positions is large. ]

"A Theory of Banking Structure," 1999, (with Ashish Nanda),

Journal of Banking and Finance, v23(6), 863-895.

[Paper].

"A Theory of Banking Structure," 1999, (with Ashish Nanda),

Journal of Banking and Finance, v23(6), 863-895.

[Paper].

[A theory to analyze the specialization of banking activities based

by function based upon two dimensions: the degree of information asymmetry

and the degree of verifiability of the value of the service rendered. ]

"Managing Rollover Risk with Capital Structure Covenants

in Structured Finance Vehicles" (2017),

(with Seoyoung Kim), Journal of Fixed Income, 26(4), 92-112.

"Managing Rollover Risk with Capital Structure Covenants

in Structured Finance Vehicles" (2017),

(with Seoyoung Kim), Journal of Fixed Income, 26(4), 92-112.

[We propose a covenant-based capital structure that mitigates rollover problems in SIVs and is Pareto-improving for equity and debt holders in the SPV.]

"The Design and Risk Management of Structured Finance Vehicles" (2016),

(with Seoyoung Kim), Journal of Risk and Financial Management,

Special Issue on Credit Risk, 1-12. doi:10.3390/jrfm9040012

"The Design and Risk Management of Structured Finance Vehicles" (2016),

(with Seoyoung Kim), Journal of Risk and Financial Management,

Special Issue on Credit Risk, 1-12. doi:10.3390/jrfm9040012

[Risk management for special investment vehicles is difficult, but necessary.

Post the recent subprime financial crisis, we inform the creation of safer SIVs

in structured finance, and propose avenues of mitigating risks faced by senior debt through

deleveraging policies in the form of leverage risk controls and contingent capital.]

"Going for Broke: Restructuring Distressed Debt Portfolios" (2014),

(with Seoyoung Kim), Journal of Fixed Income, 24(3), 5-27.

"Going for Broke: Restructuring Distressed Debt Portfolios" (2014),

(with Seoyoung Kim), Journal of Fixed Income, 24(3), 5-27.

[Optimizing portfolios where the return distributions of the assets is endogenous. The gains from restructuring distressed debt portfolios are large.]

"Basel II: Correlation Related Issues" (2007),

Journal of Financial Services Research, v32, 17-38.

"Basel II: Correlation Related Issues" (2007),

Journal of Financial Services Research, v32, 17-38.

[Analysis of correlation related issues arising in the implementation

of the Basel II accord.]

"Correlated Default Risk," (2006),

(with Laurence Freed, Gary Geng, and Nikunj Kapadia),

Journal of Fixed Income, Fall 2006, 7-32.

"Correlated Default Risk," (2006),

(with Laurence Freed, Gary Geng, and Nikunj Kapadia),

Journal of Fixed Income, Fall 2006, 7-32.

[Empirical evidence on the nature of credit correlations. Correlations

increase as markets worsen. Regime switching models are needed to explain dynamic

correlations.]

"Financial Communities" (with Jacob Sisk), 2005,

Journal of Portfolio Management, v31(4),

Summer, 112-123.

"Financial Communities" (with Jacob Sisk), 2005,

Journal of Portfolio Management, v31(4),

Summer, 112-123.

[Applying graph theory to understanding investor networks to

develop trading rules. ]

"Correlated Default Processes: A Criterion-Based Copula Approach,"

(with Gary Geng), 2004, Journal of Investment Management, v2(2), 44-70,

Special Issue on Default Risk.

[PDF]

"Correlated Default Processes: A Criterion-Based Copula Approach,"

(with Gary Geng), 2004, Journal of Investment Management, v2(2), 44-70,

Special Issue on Default Risk.

[PDF]

[Which copula and marginal distributions best describe default probability

correlations? Develops models and methodology to answer this question. ]

"Bayesian Migration in Credit Ratings Based on Probabilities of

Default," (with Rong Fan and Gary Geng), 2002, Journal of

Fixed Income, December, v12(3), 17-23.

"Bayesian Migration in Credit Ratings Based on Probabilities of

Default," (with Rong Fan and Gary Geng), 2002, Journal of

Fixed Income, December, v12(3), 17-23.

[Bayesian model for predicting rating changes based on the

dynamics of default probabilities.]

"The Impact of Correlated Default Risk on Credit Portfolios,"

(with Gifford Fong, and Gary Geng),

2001, Journal of Fixed Income, v11(3), 9-19.

"The Impact of Correlated Default Risk on Credit Portfolios,"

(with Gifford Fong, and Gary Geng),

2001, Journal of Fixed Income, v11(3), 9-19.

[The connection between credit portfolio loss distributions

and credit correlations. ]

"Contagion", 2003,

Journal of Investment Management, v1(3), 78-84.

"Contagion", 2003,

Journal of Investment Management, v1(3), 78-84.

"Useful things to know about Correlated Default Risk,"

(with Gifford Fong, Laurence Freed, Gary Geng, and Nikunj Kapadia),

2001, Extra Credit, November-December, 14-23.

"Useful things to know about Correlated Default Risk,"

(with Gifford Fong, Laurence Freed, Gary Geng, and Nikunj Kapadia),

2001, Extra Credit, November-December, 14-23.

VENTURE CAPITAL

"CapitalVX: A Machine Learning Model for Startup Selection and Exit Prediction'' 2021, (with Greg Ross, Daniel Sciro, Hussain Raza),

Journal of Finance and Data Science, v7, 94-114.

[WEB].

[WEB].

"CapitalVX: A Machine Learning Model for Startup Selection and Exit Prediction'' 2021, (with Greg Ross, Daniel Sciro, Hussain Raza),

Journal of Finance and Data Science, v7, 94-114.

[WEB].

[WEB].

[A machine learning model that attains 80-90% accuracy for

predicting startup success.]

"Venture Capital Communities" 2020, (with Amit Bubna and Nagpurnanand Prabhala),

Journal of Financial and Quantitative Analysis, v55(2), 621-651.

[JFQA]

"Venture Capital Communities" 2020, (with Amit Bubna and Nagpurnanand Prabhala),

Journal of Financial and Quantitative Analysis, v55(2), 621-651.

[JFQA]

[VCs work in communities and do better for startup firms.]

"The Fast and the Curious: VC Drift" (2020),

(with Amit Bubna and Paul Hanouna).

Journal of Financial Services Research, v57(1), 69-113.

[Link]

"The Fast and the Curious: VC Drift" (2020),

(with Amit Bubna and Paul Hanouna).

Journal of Financial Services Research, v57(1), 69-113.

[Link]

[VCs who evidence style drift underperform those who do not.]

"Polishing Diamonds in the Rough: The Sources of Syndicated Venture Performance," (2011), (with Hoje Jo and Yongtae Kim),

Journal of Financial Intermediation 20(2), 199--230.

[Paper].

"Polishing Diamonds in the Rough: The Sources of Syndicated Venture Performance," (2011), (with Hoje Jo and Yongtae Kim),

Journal of Financial Intermediation 20(2), 199--230.

[Paper].

[Syndicate-financed firms fare better---higher return multiples come from better selection, but time-to-exit and likelihood of exit are better on accont of superior monitoring by the syndicate.]

"Digital Portfolios." (2013),

Journal of Portfolio Management, v39(2), 41-48.

"Digital Portfolios." (2013),

Journal of Portfolio Management, v39(2), 41-48.

[Constructing portfolios of assets with a binary payoff, large versus zero, and the differences in this optimization versus standard mean-variance portfolio construction.]

"Private Equity Returns: An Empirical Examination of the Exit of

Venture-Backed Companies," (with Murali Jagannathan and Atulya Sarin),

2003, Journal of Investment Management, v1(1), 152-177.

"Private Equity Returns: An Empirical Examination of the Exit of

Venture-Backed Companies," (with Murali Jagannathan and Atulya Sarin),

2003, Journal of Investment Management, v1(1), 152-177.

[Gains from venture-backed investments depend upon the industry, the stage of the

firm being financed, the valuation at the time of financing, and the prevailing market

sentiment. Helps understand the risk premium required for the

valuation of private equity investments ]

"Venture Capital Syndication", (with Hoje Jo and Yongtae Kim), 2004

Journal of Investment Management, v2(4), 132-143.

"Venture Capital Syndication", (with Hoje Jo and Yongtae Kim), 2004

Journal of Investment Management, v2(4), 132-143.

DERIVATIVES / INTEREST-RATE, DEFAULT, AND LIQUIDITY RISK

"Local Volatility and the Recovery Rate of Credit Default Swaps", 2018,

(with Jeroen Jansen and Frank Fabozzi).

Journal of Economic Dynamics and Control, v92, 1-29.

[Paper].

"Local Volatility and the Recovery Rate of Credit Default Swaps", 2018,

(with Jeroen Jansen and Frank Fabozzi).

Journal of Economic Dynamics and Control, v92, 1-29.

[Paper].

[Implied recovery rates on default using information from the CDS markets and the volatility surface.]

"An Index-Based Measure of Liquidity,'' 2016, (with George Chacko and Rong Fan).

Journal of Banking and Finance, 68, 162-178.

[Paper].

"An Index-Based Measure of Liquidity,'' 2016, (with George Chacko and Rong Fan).

Journal of Banking and Finance, 68, 162-178.

[Paper].

[ Develops a new measure of liquidity for all sectors of the markets using ETFs.

RFinance Best Paper Award, May 2016. This paper won the S&P SPIVA 2012 Award for innovation of an index.]

"Credit Spreads with Dynamic Debt" (with Seoyoung Kim), (2015),

Journal of Banking and Finance, v50, 121-140.

[Paper].

"Credit Spreads with Dynamic Debt" (with Seoyoung Kim), (2015),

Journal of Banking and Finance, v50, 121-140.

[Paper].

[Extends the Merton risky debt model from static debt to dynamic debt

and generates credit spread term structures that are closer to those in the data. Won the National Stock Exchange of India Best Paper Award, at the Center for Analytic Finance Conference, ISB, Hyderabad]

"Did CDS Trading Improve

the Market for Corporate Bonds?" (with Madhu Kalimipalli and Subhankar Nayak), (2014),

Journal of Financial Economics 111, 495-525.

[Paper].

"Did CDS Trading Improve

the Market for Corporate Bonds?" (with Madhu Kalimipalli and Subhankar Nayak), (2014),

Journal of Financial Economics 111, 495-525.

[Paper].

[The inception of CDS trading in a reference name renders its bonds less efficient, with no improvement in market quality or liquidity]

"Strategic Loan Modification: An Options-Based Response to Strategic Default,"

(with Ray Meadows), (2013), Journal of Banking and Finance 37, 636-647.

[Paper].

"Strategic Loan Modification: An Options-Based Response to Strategic Default,"

(with Ray Meadows), (2013), Journal of Banking and Finance 37, 636-647.

[Paper].

[A closed-form solution for mortgage debt with default and optimal loan modificatoin thereon.]

"The Principal Principle," (2012), Journal of Financial and Quantitative Analysis, 47(6), 1215-1246.

[PDF].

[JSTOR].

"The Principal Principle," (2012), Journal of Financial and Quantitative Analysis, 47(6), 1215-1246.

[PDF].

[JSTOR].

[Optimal approaches for mortgage loan modification. Principal reduction is optimal, and better than rate reductions, maturity extensions, and principal forebearance. Shared-appreciation mortgages solve moral hazard.]

"Run Lengths and Liquidity," (with Paul Hanouna), (2010),

Annals of Operations Resarch, Special Issue on Risk and Uncertainty, 176(1), 127-152.

[Paper].

"Run Lengths and Liquidity," (with Paul Hanouna), (2010),

Annals of Operations Resarch, Special Issue on Risk and Uncertainty, 176(1), 127-152.

[Paper].

[The run signature of a stock is shown to be mathematically related to liquidity. Runs are

priced factors. ]

"Implied Recovery,'' (with Paul Hanouna), (2009),

Journal of Economic Dynamics and Control, 33(11), 1837-1857.

[Paper].

"Implied Recovery,'' (with Paul Hanouna), (2009),

Journal of Economic Dynamics and Control, 33(11), 1837-1857.

[Paper].

[How to use the term structure of CDS spreads to jointly identify the term structures of forward default probability and recovery rates. ]

"Accounting-based versus market-based cross-sectional models of CDS spreads,"

(with Paul Hanouna and Atulya Sarin), (2009),

Journal of Banking and Finance, 33, 719-730.

[Paper].

"Accounting-based versus market-based cross-sectional models of CDS spreads,"

(with Paul Hanouna and Atulya Sarin), (2009),

Journal of Banking and Finance, 33, 719-730.

[Paper].

[Accounting models explain spreads as well as market-based ones, but a hybrid mix does best.]

"Hedging Credit: Equity Liquidity Matters," (with Paul Hanouna), (2009),

Journal of Financial Intermediation, v18(1), 112-123.

[Paper].

"Hedging Credit: Equity Liquidity Matters," (with Paul Hanouna), (2009),

Journal of Financial Intermediation, v18(1), 112-123.

[Paper].

[Hedging in CDS markets provides a mechanism by which equity market liquidity impacts CDS spreads ]

"An Integrated Model for Hybrid Securities,"

(with Raghu Sundaram), (2007), Management Science, v53, 1439-1451.

[Paper].

"An Integrated Model for Hybrid Securities,"

(with Raghu Sundaram), (2007), Management Science, v53, 1439-1451.

[Paper].

[A general flexible model for pricing derivative securities that depend on equity,

interest rate and credit risk, using observables. Delivers dynamic implied default probabilities.]

"Common Failings: How Corporate Defaults are Correlated"

(with Darrell Duffie, Nikunj Kapadia and Leandro Saita).

(2007) Journal of Finance, v62, 93-117.

[Paper].

"Common Failings: How Corporate Defaults are Correlated"

(with Darrell Duffie, Nikunj Kapadia and Leandro Saita).

(2007) Journal of Finance, v62, 93-117.

[Paper].

[New approach to test for defaul contagion using a stochastic time change.

Doubly stochastic models are refuted by the data.]

"Pricing Credit derivatives with Rating Transitions,"

(with Viral Acharya and Rangarajan Sundaram), 2002,

Financial Analysts Journal, May-June, 28-44.

[Paper].

"Pricing Credit derivatives with Rating Transitions,"

(with Viral Acharya and Rangarajan Sundaram), 2002,

Financial Analysts Journal, May-June, 28-44.

[Paper].

[A HJM type two-factor model in risk free rates and spreads that also accounts

for rating transitions, allowing seamless pricing of many credit derivatives. ]

"The Surprise Element: Jumps in Interest Rates", 2002, Journal of

Econometrics, v106, 27-65.

[Paper].

"The Surprise Element: Jumps in Interest Rates", 2002, Journal of

Econometrics, v106, 27-65.

[Paper].

[Estimation methodology for interest rates with jumps. A flexible

specification that accommodates Federal Reserve Activity.]

"Pricing Interest Rate Derivatives: A General Approach,''(with George Chacko),

2002, Review of Financial Studies, v15(1), 195-241.

[Paper].

"Pricing Interest Rate Derivatives: A General Approach,''(with George Chacko),

2002, Review of Financial Studies, v15(1), 195-241.

[Paper].

[General affine option pricing for interest rate derivatives covering a

wide range of securities, allowing for M factors with N diffusions and L jumps.]

"A Discrete-Time Approach to Arbitrage-Free Pricing of Credit Derivatives,''

(with Rangarajan Sundaram), 2000, Management Science, v46(1), 46-62.

[Paper].

"A Discrete-Time Approach to Arbitrage-Free Pricing of Credit Derivatives,''

(with Rangarajan Sundaram), 2000, Management Science, v46(1), 46-62.

[Paper].

[HJM style two factor model for credit risk. ]

"Of Smiles and Smirks: A Term Structure Perspective,''

1999, (with Rangarajan Sundaram), Journal of

Financial and Quantitative Analysis, v34(2), 211-240.

[JSTOR].

"Of Smiles and Smirks: A Term Structure Perspective,''

1999, (with Rangarajan Sundaram), Journal of

Financial and Quantitative Analysis, v34(2), 211-240.

[JSTOR].

[Explains how the shape of the volatility smile is determined by

jumps and stochastic volatility. ]

"A Direct Discrete-Time Approach to

Poisson-Gaussian Bond Option Pricing in the Heath-Jarrow-Morton

Model," 1999, Journal of Economic Dynamics and Control, v23(3), 333-369.

[Paper].

"A Direct Discrete-Time Approach to

Poisson-Gaussian Bond Option Pricing in the Heath-Jarrow-Morton

Model," 1999, Journal of Economic Dynamics and Control, v23(3), 333-369.

[Paper].

[HJM tree with jumps. Fast, fully recombining dynamics. ]

"The Central Tendency: A Second Factor in

Bond Yields," 1998, (with Silverio Foresi and Pierluigi Balduzzi),

The Review of Economics and Statistics, v80(1), 60-72.

[Paper].

"The Central Tendency: A Second Factor in

Bond Yields," 1998, (with Silverio Foresi and Pierluigi Balduzzi),

The Review of Economics and Statistics, v80(1), 60-72.

[Paper].

[Model of the term structure with stochastic long-run mean. Related to

Federal Reserve acitivity.]

"Options on Portfolios with Higher-Order Moments," (2009),

(with Rishabh Bhandari), Finance Research Letters, v6, 122-129.

"Options on Portfolios with Higher-Order Moments," (2009),

(with Rishabh Bhandari), Finance Research Letters, v6, 122-129.

[How to model fat-tailed portfolio distributions for

options on a multivariate system of assets, calibrated to the return

means, covariance matrix, coskewness and cokurtosis tensors.]

"Dealing with Dimension: Option Pricing on Factor Trees," (2009),

(with Brian Granger), Journal of Investment Management, 7(2), 73-85.

"Dealing with Dimension: Option Pricing on Factor Trees," (2009),

(with Brian Granger), Journal of Investment Management, 7(2), 73-85.

[Multifactor representations of securities on high-dimensional trees. Allows

you to price options on multiple assets in a unified fraamework. Computational

results assess using multithreading.]

"Modeling

Correlated Default with a Forest of Binomial Trees," (2007), (with

Santhosh Bandreddi and Rong Fan), Journal of Fixed

Income. Winter, 1-20.

"Modeling

Correlated Default with a Forest of Binomial Trees," (2007), (with

Santhosh Bandreddi and Rong Fan), Journal of Fixed

Income. Winter, 1-20.

[Extends the Das-Sundaram hybrid securities model to correlated default modeling. ]

"A Simple Model for Pricing Equity Options with Markov

Switching State Variables" (2006),

(with Donald Aingworth and Rajeev Motwani),

Quantitative Finance, v6(2), 95-105.

"A Simple Model for Pricing Equity Options with Markov

Switching State Variables" (2006),

(with Donald Aingworth and Rajeev Motwani),

Quantitative Finance, v6(2), 95-105.

[A tree model for options when the underlying has regime switches.]

"Monte Carlo Markov Chain Methods for Derivative Pricing

and Risk Assessment,"(with Alistair Sinclair), 2005,

Journal of Investment Management, v3(1), 29-44.

[PDF]

"Monte Carlo Markov Chain Methods for Derivative Pricing

and Risk Assessment,"(with Alistair Sinclair), 2005,

Journal of Investment Management, v3(1), 29-44.

[PDF]

[Randomized algorithm using MCMC on very large option pricing trees

where incomplete information about the value of an asset may be exploited to

undertake fast and accurate pricing. Proof that a fully polynomial randomized

approximation scheme (FPRAS) is available.]

"Discrete-Time Bond and Option Pricing for Jump-Diffusion

Processes," 1997, Review of Derivatives Research, v1(3), 211-244.

"Discrete-Time Bond and Option Pricing for Jump-Diffusion

Processes," 1997, Review of Derivatives Research, v1(3), 211-244.

[Extends the finite-differencing approach for interest rate derivatives

to jump processes.]

"A Simple Approach to Three Factor Affine Models of the

Term Structure," (with Pierluigi Balduzzi, Silverio Foresi and Rangarajan

Sundaram), 1996, Journal of Fixed Income, v6(3), 43-53.

"A Simple Approach to Three Factor Affine Models of the

Term Structure," (with Pierluigi Balduzzi, Silverio Foresi and Rangarajan

Sundaram), 1996, Journal of Fixed Income, v6(3), 43-53.

[ An easy way to calibrate three factor models using method of moments. ]

-

"Analytical Approximations of the Term Structure

for Jump-diffusion Processes: A Numerical Analysis," 1996,

(with Jamil Baz), Journal of Fixed Income, v6(1), 78-86.

"Analytical Approximations of the Term Structure

for Jump-diffusion Processes: A Numerical Analysis," 1996,

(with Jamil Baz), Journal of Fixed Income, v6(1), 78-86.

[An exact solution to an approximate PDE may be better than

an approximate solution to an exact PDDE for term structure models. ]

-

"Revisiting

Markov Chain Term Structure Models: Extensions and Applications,"

1996, Financial Practice and Education, v6(1), 33-45.

"Revisiting

Markov Chain Term Structure Models: Extensions and Applications,"

1996, Financial Practice and Education, v6(1), 33-45.

[A new pedagogy for Markov models of interest rates. ]

-

"Exact Solutions for Bond and Options Prices

with Systematic Jump Risk," 1996, (with Silverio Foresi),

Review of Derivatives Research, v1(1), 7-24.

"Exact Solutions for Bond and Options Prices

with Systematic Jump Risk," 1996, (with Silverio Foresi),

Review of Derivatives Research, v1(1), 7-24.

[First paper to show that affine solutions exist for

jump-diffusion term structure models.]

-

"Pricing Credit Sensitive Debt when Interest Rates, Credit Ratings

and Credit Spreads are Stochastic," 1996,

(with Peter Tufano), The Journal of Financial Engineering,

v5(2), 161-198.

"Pricing Credit Sensitive Debt when Interest Rates, Credit Ratings

and Credit Spreads are Stochastic," 1996,

(with Peter Tufano), The Journal of Financial Engineering,

v5(2), 161-198.

[Rating based model for credit derivatives with correlation between recovery

rates, interest rates and default probabilities. ]

-

"Credit Risk Derivatives," Journal of Derivatives, 1995, pg 7-21.

Claims Analysis in Corporate Finance,'' edited by Michel Crouhy,

Dan Galai, and Zvi Wiener, World Scientific Press 2019.)

"Credit Risk Derivatives," Journal of Derivatives, 1995, pg 7-21.

Claims Analysis in Corporate Finance,'' edited by Michel Crouhy,

Dan Galai, and Zvi Wiener, World Scientific Press 2019.)

[Introduces early models for pricing credit derivatives as compound options. ]

-

``Credit Risk Derivatives,'', Contingent Claims Analysis in Corporate Finance, (2019)

editors Michel Crouhy, Dan Galai, Zvi Wiener.

(Reprint of article in Journal of Derivatives, 1995.)

"Did CDS Trading Improve the Market for Corporate Bonds," (2016),

(with Madhu Kalimipalli and Subhankar Nayak),

Finance and Accounting Memos Issue 3, 45--49.

"Did CDS Trading Improve the Market for Corporate Bonds," (2016),

(with Madhu Kalimipalli and Subhankar Nayak),

Finance and Accounting Memos Issue 3, 45--49.

[CDS trading adversely impacted the bond market.]

"Random Lattices for Option Pricing Problems in Finance," (2011),

Journal of Investment Management, 9(2), 88-106.

"Random Lattices for Option Pricing Problems in Finance," (2011),

Journal of Investment Management, 9(2), 88-106.

"Implementing Option Pricing Models using Python and Cython," (2010),

(with Brian Granger), Journal of Investment Management, 9(4), 72-84

"Implementing Option Pricing Models using Python and Cython," (2010),

(with Brian Granger), Journal of Investment Management, 9(4), 72-84

"Recovery Swaps," (2009), (with Paul Hanouna),

Encyclopedia of Quantitative Finance, John Wiley and Sons, U.K., 1507--1509

"Recovery Swaps," (2009), (with Paul Hanouna),

Encyclopedia of Quantitative Finance, John Wiley and Sons, U.K., 1507--1509

"Recovery Rates," (2009),(with Paul Hanouna),

Encyclopedia of Quantitative Finance, John Wiley and Sons, U.K., 1505--1507

"Recovery Rates," (2009),(with Paul Hanouna),

Encyclopedia of Quantitative Finance, John Wiley and Sons, U.K., 1505--1507

``A Simple Model for Pricing Securities with a Debt-Equity Linkage,'' 2008, in

Innovations in Investment Management, Bloomberg Press, 85-112.

``A Simple Model for Pricing Securities with a Debt-Equity Linkage,'' 2008, in

Innovations in Investment Management, Bloomberg Press, 85-112.

"Credit Default Swap Spreads", 2006, (with Paul Hanouna),

Journal of Investment Management, v4(3), 93-105.

"Credit Default Swap Spreads", 2006, (with Paul Hanouna),

Journal of Investment Management, v4(3), 93-105.

"Recovery Risk," 2005,

Journal of Investment Management, v3(1), 113-120.

"Recovery Risk," 2005,

Journal of Investment Management, v3(1), 113-120.

"Liquidity and the Bond Markets, (with Jan Ericsson and

Madhu Kalimipalli), 2003,

Journal of Investment Management, v1(4), 95-103.

"Liquidity and the Bond Markets, (with Jan Ericsson and

Madhu Kalimipalli), 2003,

Journal of Investment Management, v1(4), 95-103.

"Modern Pricing of Interest Rate Derivatives - Book Review",

2004, Journal of Economic Literature, vXLII, 528-529.

"Modern Pricing of Interest Rate Derivatives - Book Review",

2004, Journal of Economic Literature, vXLII, 528-529.

"A Discrete-Time Approach to Arbitrage-Free Pricing of Credit Derivatives,''

(with Rangarajan Sundaram), reprinted in

the Courant Institute of Mathematical Sciences, special volume on

Quantitative Analysis in Financial Markets, Volume III, 2001.

"A Discrete-Time Approach to Arbitrage-Free Pricing of Credit Derivatives,''

(with Rangarajan Sundaram), reprinted in

the Courant Institute of Mathematical Sciences, special volume on

Quantitative Analysis in Financial Markets, Volume III, 2001.

"Stochastic Mean Models of the Term Structure,''

(with Pierluigi Balduzzi, Silverio Foresi and Rangarajan Sundaram),

2000, Advanced Fixed-Income Valuation Tools

, edited by N. Jegadeesh and B. Tuckman,

John Wiley & Sons, Inc., 128-161.

"Stochastic Mean Models of the Term Structure,''

(with Pierluigi Balduzzi, Silverio Foresi and Rangarajan Sundaram),

2000, Advanced Fixed-Income Valuation Tools

, edited by N. Jegadeesh and B. Tuckman,

John Wiley & Sons, Inc., 128-161.

"Interest Rate Modeling with Jump-Diffusion Processes,''

2000, Advanced Fixed-Income Valuation Tools

, edited by N. Jegadeesh and B. Tuckman,

John Wiley & Sons, Inc., 162-189.

"Interest Rate Modeling with Jump-Diffusion Processes,''

2000, Advanced Fixed-Income Valuation Tools

, edited by N. Jegadeesh and B. Tuckman,

John Wiley & Sons, Inc., 162-189.

Comments on 'Pricing Excess-of-Loss Reinsurance Contracts against

Catastrophic Loss,' by J. David Cummins, C. Lewis, and Richard Phillips,

in The Financing of Catastrophe Risk, Kenneth A

Froot (Ed.), University of Chicago Press, 1999, 141-145.

Comments on 'Pricing Excess-of-Loss Reinsurance Contracts against

Catastrophic Loss,' by J. David Cummins, C. Lewis, and Richard Phillips,

in The Financing of Catastrophe Risk, Kenneth A

Froot (Ed.), University of Chicago Press, 1999, 141-145.

"Pricing Credit Derivatives,''

1999, Handbook of Credit Derivatives, eds J. Francis,

J. Frost and J.G. Whittaker, 101-138.

"Pricing Credit Derivatives,''

1999, Handbook of Credit Derivatives, eds J. Francis,

J. Frost and J.G. Whittaker, 101-138.

"On the Recursive Implementation of Term Structure Models,''

1998, Pecunia, The Netherlands, Summer 1998, 45-49.

"On the Recursive Implementation of Term Structure Models,''

1998, Pecunia, The Netherlands, Summer 1998, 45-49.

ASSET PRICING

-

"Efficiency with Costly Information: A Reinterpretation of

Evidence from Managed Portfolios," (with Edwin Elton, Martin Gruber and Matt

Hlavka), Review of Financial Studies, vol. 6(1), 1993, pp 1-22.

[Paper].

"Efficiency with Costly Information: A Reinterpretation of

Evidence from Managed Portfolios," (with Edwin Elton, Martin Gruber and Matt

Hlavka), Review of Financial Studies, vol. 6(1), 1993, pp 1-22.

[Paper].

[Mutual funds are not informationally efficient.

You are better off buying the index.]

Presented and Reprinted in the Proceedings of The

Seminar on the Analysis of Security Prices at the Center

for Research in Security Prices at the University of

Chicago, Graduate School of Business.

"Are Markets Truly Efficient? Experiments using Deep Learning Algorithms for Market Movement Prediction", 2018,

(with Karthik Mokashi and Robbie Culkin).

Algorithms, v11, 138, doi:10.3390/a11090138.

[Online].

[Correction, updated programs and data.].

"Are Markets Truly Efficient? Experiments using Deep Learning Algorithms for Market Movement Prediction", 2018,

(with Karthik Mokashi and Robbie Culkin).

Algorithms, v11, 138, doi:10.3390/a11090138.

[Online].

[Correction, updated programs and data.].

[How to use Deep Learning to undertake a large-scale test of efficiency of the stock index.]

MISCELLANEOUS TOPICS

"The Firm's Management of Social Interactions," (2005)

(with D. Godes, D. Mayzlin, Y. Chen, S. Das, C. Dellarocas,

B. Pfeieffer, B. Libai, S. Sen, M. Shi, and P. Verlegh).

Marketing Letters, v16, 415-428.Ê

"The Firm's Management of Social Interactions," (2005)

(with D. Godes, D. Mayzlin, Y. Chen, S. Das, C. Dellarocas,

B. Pfeieffer, B. Libai, S. Sen, M. Shi, and P. Verlegh).

Marketing Letters, v16, 415-428.Ê

[A framework for how word-of-mouth communication is modeled in

the practice of marketing. ]

"Macroeconomic Implications of Search Theory for the Labor Market,"

1997, Applied Economics Letters, December, v4, 719-723.

"Macroeconomic Implications of Search Theory for the Labor Market,"

1997, Applied Economics Letters, December, v4, 719-723.

[Connects option pricing theory to labor search theory. Calibrates to

labor market data.]

-

"Auction Theory: A Summary with Applications and Evidence

from the Treasury Markets," 1996, (with Rangarajan Sundaram),

Financial Markets, Institutions and Instruments, v5(5), 1-36.

"Auction Theory: A Summary with Applications and Evidence

from the Treasury Markets," 1996, (with Rangarajan Sundaram),

Financial Markets, Institutions and Instruments, v5(5), 1-36.

[A survey of models and literature on Treasury Auctions. ]

"Power Laws," 2005, (with Jacob Sisk),

Journal of Investment Management, v3(3), 84-91.

[PDF]

"Power Laws," 2005, (with Jacob Sisk),

Journal of Investment Management, v3(3), 84-91.

[PDF]

"Genetic Algorithms," 2005,

Journal of Investment Management, v3(2), 77-82.

"Genetic Algorithms," 2005,

Journal of Investment Management, v3(2), 77-82.

"Technical Analysis", (with David Tien), 2004

Journal of Investment Management, v2(1), 79-85.

"Technical Analysis", (with David Tien), 2004

Journal of Investment Management, v2(1), 79-85.

"Hedge Funds", 2003,

Journal of Investment Management, v1(2), 76-81.

Reprinted in

"Working Papers on Hedge Funds," in The World of Hedge Funds:

Characteristics and

Analysis, 2005, World Scientific.

"Hedge Funds", 2003,

Journal of Investment Management, v1(2), 76-81.

Reprinted in

"Working Papers on Hedge Funds," in The World of Hedge Funds:

Characteristics and

Analysis, 2005, World Scientific.

"The Internet and Investors", 2003,

Journal of Investment Management, v1(1), 213-217.

"The Internet and Investors", 2003,

Journal of Investment Management, v1(1), 213-217.

WORKING PAPERS

"Project Lifecycles in Open Source Software"

(with Brian Granger, Piyush Jain, David Qiu, Andrii Iersoshenko, Michael Chin).

[GitHub].

"Project Lifecycles in Open Source Software"

(with Brian Granger, Piyush Jain, David Qiu, Andrii Iersoshenko, Michael Chin).

[GitHub].

"A Meta Reinforcement Learning Approach to Goals-Based Wealth Management"

(with Harshad Khadilkar, Sukrit Mittal, Daniel Ostrov, Deep Srivastav, Hungjen Wang).

[PDF].

"A Meta Reinforcement Learning Approach to Goals-Based Wealth Management"

(with Harshad Khadilkar, Sukrit Mittal, Daniel Ostrov, Deep Srivastav, Hungjen Wang).

[PDF].

"PPLqa: An Unsupervised Information-Theoretic Quality Metric for Comparing Generative Large Language Models",

(with Gerald Friedland, Xin Huang, Yueying Cui, Vishaal Kapoor, Ashish Khetan),

[arXiv]

[LinkedIn]

"PPLqa: An Unsupervised Information-Theoretic Quality Metric for Comparing Generative Large Language Models",

(with Gerald Friedland, Xin Huang, Yueying Cui, Vishaal Kapoor, Ashish Khetan),

[arXiv]

[LinkedIn]

"Diverse Counterfactual Explanations for Anomaly Detection in Time Series",

(with Deborah Sulem, Michele Donini, Muhammad Bilal Zafar,

Francois-Xavier Aubet, Jan Gasthaus, Tim Januschowski,

Krishnaram Kenthapadi, Cedric Archambeau),

[arXiv].

"Diverse Counterfactual Explanations for Anomaly Detection in Time Series",

(with Deborah Sulem, Michele Donini, Muhammad Bilal Zafar,

Francois-Xavier Aubet, Jan Gasthaus, Tim Januschowski,

Krishnaram Kenthapadi, Cedric Archambeau),

[arXiv].

"More Than Words: Towards Better Quality Interpretations of Text

Classifiers", (with Muhammad Bilal Zafar, Philipp Schmidt,

Michele Donini, Cédric Archambeau, Felix Biessmann, Krishnaram Kenthapadi),

[arXiv].

"More Than Words: Towards Better Quality Interpretations of Text

Classifiers", (with Muhammad Bilal Zafar, Philipp Schmidt,

Michele Donini, Cédric Archambeau, Felix Biessmann, Krishnaram Kenthapadi),

[arXiv].

"Measuring Productivity and User Engagement from Workplace

Network Interactions"

(with Ivan Galea, Kailin Hu, Mugdha Potdar,

Preethi Subbrayan Ranganathan, Mark Scarr,

Anand Subramanian, Hariharan Swaminathan, Xiang Zhang)

[PDF].

"Measuring Productivity and User Engagement from Workplace

Network Interactions"

(with Ivan Galea, Kailin Hu, Mugdha Potdar,

Preethi Subbrayan Ranganathan, Mark Scarr,

Anand Subramanian, Hariharan Swaminathan, Xiang Zhang)

[PDF].

My page on SSRN (with downloadable papers) is here.

"Academic Life: (A)musings from the Ivory Tower"

PDF.

[A collection of essays and notes to myself about academic life.]

"Academic Life: (A)musings from the Ivory Tower"

PDF.

[A collection of essays and notes to myself about academic life.]

"Natural Language Processing" (web book)

Read here.

"Natural Language Processing" (web book)

Read here.

"Data Science: Theories, Models, Algorithms, and Analytics" (web book -- work in progress)

Read here.

Real-time web version (using R)

Data for the examples in the book

Real-time web version (WIP: using Python and R)

"Data Science: Theories, Models, Algorithms, and Analytics" (web book -- work in progress)

Read here.

Real-time web version (using R)

Data for the examples in the book

Real-time web version (WIP: using Python and R)

"Derivatives: Principles and Practice" (1st edition 2010, 2nd edition 2016),

(Rangarajan Sundaram and Sanjiv Das), McGraw Hill.

[Amazon]

[BarnesNoble]

"Derivatives: Principles and Practice" (1st edition 2010, 2nd edition 2016),

(Rangarajan Sundaram and Sanjiv Das), McGraw Hill.

[Amazon]

[BarnesNoble]

"Deep Learning" (web book with Subir Varma -- work in progress)

Real-time web version

Real-time web version (using Python and R)

"Deep Learning" (web book with Subir Varma -- work in progress)

Real-time web version

Real-time web version (using Python and R)

"The Psychology of Financial Decision Making: A Case

for Theory-Driven Experimental Enquiry,''

1999, (with Priya Raghubir),

Financial Analyst's Journal, Nov-Dec 1999, v55(6), 56-79.

"The Psychology of Financial Decision Making: A Case

for Theory-Driven Experimental Enquiry,''

1999, (with Priya Raghubir),

Financial Analyst's Journal, Nov-Dec 1999, v55(6), 56-79.

"Systemic Risk and International Portfolio Choice,"

(with Raman Uppal), 2004, Journal of Finance, v59(6), 2809-2834.

"Systemic Risk and International Portfolio Choice,"

(with Raman Uppal), 2004, Journal of Finance, v59(6), 2809-2834.

"Useful things to know about Correlated Default Risk,"

(with Gifford Fong, Laurence Freed, Gary Geng, and Nikunj Kapadia),

2001, Extra Credit, November-December, 14-23.

"Useful things to know about Correlated Default Risk,"

(with Gifford Fong, Laurence Freed, Gary Geng, and Nikunj Kapadia),

2001, Extra Credit, November-December, 14-23.

"Are Markets Truly Efficient? Experiments using Deep Learning Algorithms for Market Movement Prediction", 2018,

(with Karthik Mokashi and Robbie Culkin).

Algorithms, v11, 138, doi:10.3390/a11090138.

"Are Markets Truly Efficient? Experiments using Deep Learning Algorithms for Market Movement Prediction", 2018,

(with Karthik Mokashi and Robbie Culkin).

Algorithms, v11, 138, doi:10.3390/a11090138.

"Project Lifecycles in Open Source Software"

(with Brian Granger, Piyush Jain, David Qiu, Andrii Iersoshenko, Michael Chin).

"Project Lifecycles in Open Source Software"

(with Brian Granger, Piyush Jain, David Qiu, Andrii Iersoshenko, Michael Chin).