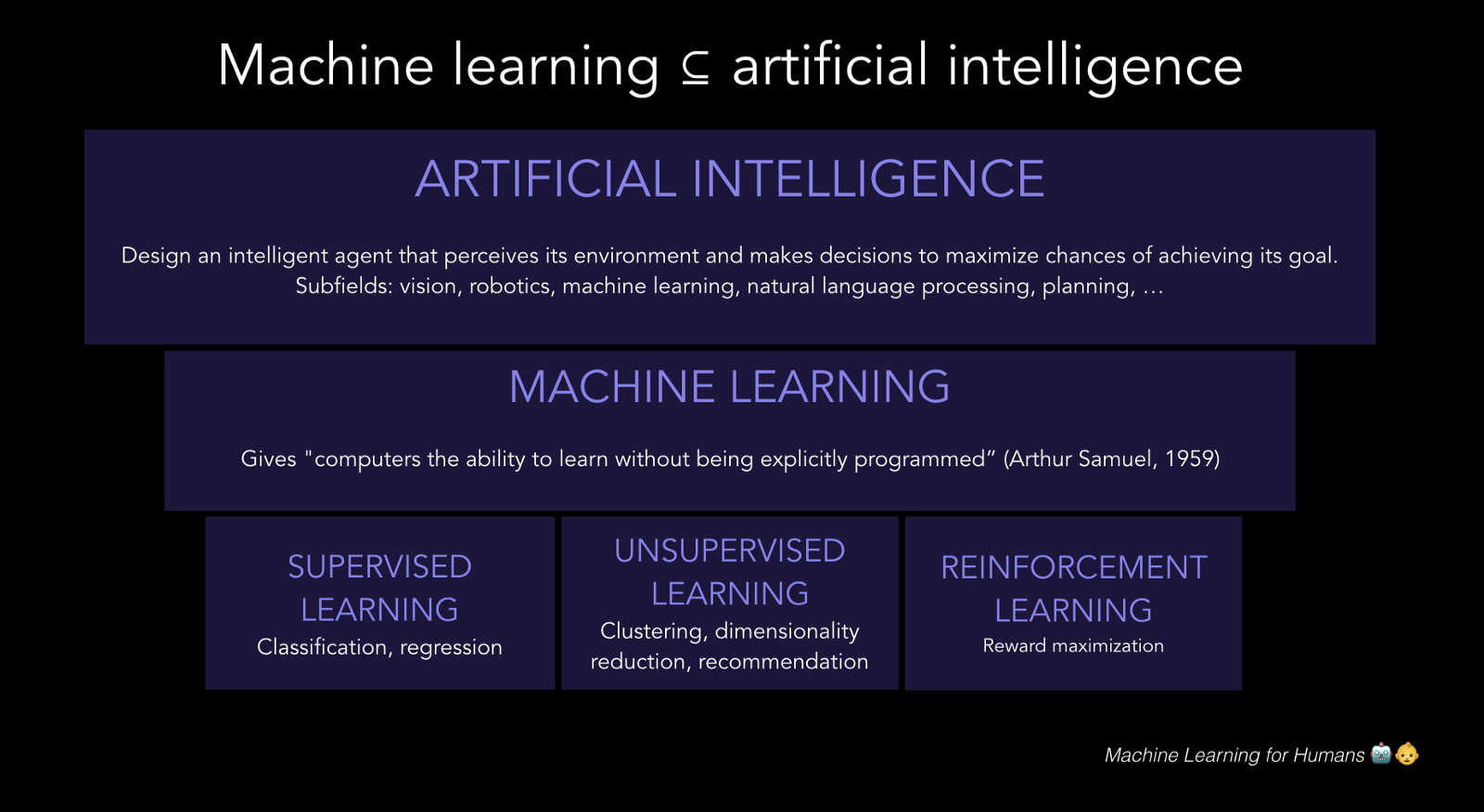

8. Machine Learning: A Quick Introduction#

A quick recap of machine learning before we get started with NLP.

8.1. Jupyter Extensions#

These allow using the notebooks in myriad ways, see: https://blog.jupyter.org/99-ways-to-extend-the-jupyter-ecosystem-11e5dab7c54

from google.colab import drive

drive.mount('/content/drive') # Add My Drive/<>

import os

os.chdir('drive/My Drive')

os.chdir('Books_Writings/NLPBook/')

Mounted at /content/drive

%%capture

# %pylab inline

import pandas as pd

import os

import numpy as np

import matplotlib.pyplot as plt

from IPython.display import Image

https://medium.com/machine-learning-for-humans/why-machine-learning-matters-6164faf1df12

8.2. 5 Applications of ML in Finance#

https://www.verypossible.com/blog/5-applications-of-machine-learning-in-finance

https://towardsdatascience.com/machine-learning-in-finance-why-what-how-d524a2357b56

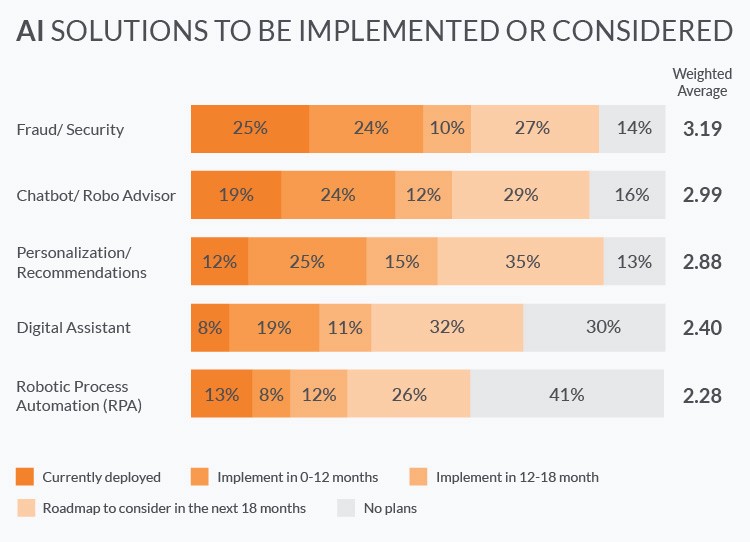

8.3. Many Applications of ML in Finance#

Fraud prevention

Risk management

Investment predictions

Customer service

Digital assistants

Marketing

Network security

Loan underwriting

Algorithmic trading

Process automation

Document interpretation

Content creation

Trade settlements

Money-laundering prevention

Custom machine learning solutions

https://igniteoutsourcing.com/fintech/machine-learning-in-finance/

For projects, start looking at Kaggle for finance datasets you may be able to use.

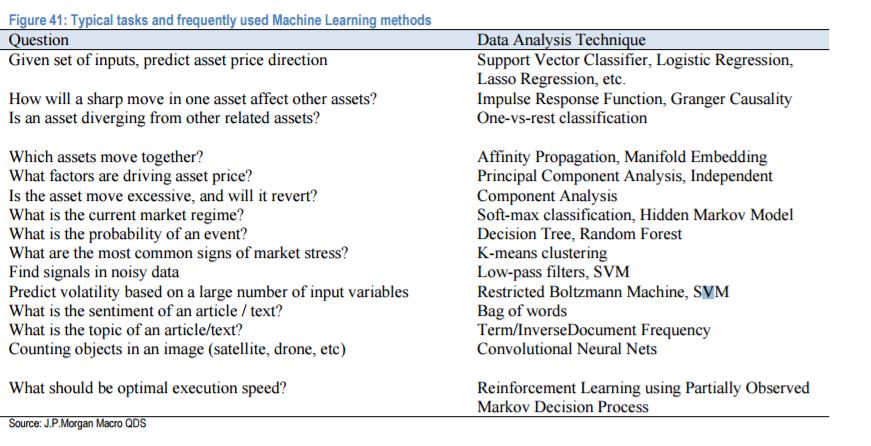

8.4. J.P. Morgan Guide to ML in Finance#

https://news.efinancialcareers.com/uk-en/285249/machine-learning-and-big-data-j-p-morgan

“You won’t need to be a machine learning expert, you will need to be an excellent quant and an excellent programmer

J.P. Morgan says the skillset for the role of data scientists is virtually the same as for any other quantitative researchers. Existing buy side and sell side quants with backgrounds in computer science, statistics, maths, financial engineering, econometrics and natural sciences should therefore be able to reinvent themselves. Expertise in quantitative trading strategies will be the crucial skill. “It is much easier for a quant researcher to change the format/size of a dataset, and employ better statistical and Machine Learning tools, than for an IT expert, silicon valley entrepreneur, or academic to learn how to design a viable trading strategy,” say Kolanovic and Krishnamacharc.”

8.5. ML Tasks in Finance#

8.6. ML with NLP#

Credit scoring, sentiment analysis, document search: https://emerj.com/ai-sector-overviews/natural-language-processing-applications-in-finance-3-current-applications/

Gather real-time intelligence on specific stocks; Provide key hire alerts; Monitor company sentiment; Anticipate client concerns; Upgrade quality of analyst reporting; Understand and respond to news events; Detect insider trading: https://www.ibm.com/blogs/watson/2016/06/natural-language-processing-transforming-financial-industry-2/

Ravenpack: https://www.ravenpack.com/; https://www.ravenpack.com/research/browse/

8.7. scikit-learn: Python’s one-stop shop for ML#

8.8. Supervised Learning Models#

Linear Models

Logistic Regression

Discriminant Analysis

Bayes Classifier

Support Vector Machines

Nearest Neighbors (kNN)

Decision Trees

Neural Networks

8.9. Unsupervised Learning Models#

8.9.1. Clustering#

K-means

Hierarchical clustering

8.9.2. Dimension Reduction#

Principal Components Analysis

Factor Analysis

Autoencoders

8.10. Ensemble Methods#

Bagging

Stacking

Boosting

8.11. Small Business Association (SBA) Loans Dataset#

#Import the SBA Loans dataset

pd.set_option('display.max_columns', 500)

sba = pd.read_csv("NLP_data/SBA.csv")

print(sba.columns)

print(sba.shape)

sba.head()

Index(['LoanID', 'GrossApproval', 'SBAGuaranteedApproval', 'subpgmdesc',

'ApprovalFiscalYear', 'InitialInterestRate', 'TermInMonths',

'ProjectState', 'BusinessType', 'LoanStatus', 'RevolverStatus',

'JobsSupported'],

dtype='object')

(527700, 12)

| LoanID | GrossApproval | SBAGuaranteedApproval | subpgmdesc | ApprovalFiscalYear | InitialInterestRate | TermInMonths | ProjectState | BusinessType | LoanStatus | RevolverStatus | JobsSupported | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 733784 | 50000 | 25000 | FA$TRK (Small Loan Express) | 2006 | 11.25 | 84 | IN | CORPORATION | CANCLD | 1 | 4 |

| 1 | 733785 | 35000 | 17500 | FA$TRK (Small Loan Express) | 2006 | 12.00 | 84 | IL | CORPORATION | CANCLD | 0 | 3 |

| 2 | 733786 | 15000 | 7500 | FA$TRK (Small Loan Express) | 2006 | 12.00 | 84 | WV | INDIVIDUAL | CANCLD | 0 | 4 |

| 3 | 733787 | 16000 | 13600 | Community Express | 2006 | 11.50 | 84 | MD | CORPORATION | PIF | 0 | 1 |

| 4 | 733788 | 16000 | 13600 | Community Express | 2006 | 11.50 | 84 | MD | CORPORATION | CANCLD | 0 | 1 |

8.12. Feature Engineering#

#Feature engineering

sba["GuaranteePct"] = sba.SBAGuaranteedApproval.astype("float")/sba.GrossApproval.astype("float")

X = sba[['ApprovalFiscalYear', 'InitialInterestRate', 'TermInMonths',

'RevolverStatus','JobsSupported','GuaranteePct']]

x1 = pd.get_dummies(sba.subpgmdesc, dtype=int)

X = pd.concat([X,x1],axis=1)

x2 = pd.get_dummies(sba.BusinessType, dtype=int)

X = pd.concat([X,x2],axis=1)

X.head()

| ApprovalFiscalYear | InitialInterestRate | TermInMonths | RevolverStatus | JobsSupported | GuaranteePct | 509 - DEALER FLOOR PLAN | Community Advantage Initiative | Community Express | Contract Guaranty | EXPORT IMPORT HARMONIZATION | FA$TRK (Small Loan Express) | Guaranty | Gulf Opportunity | International Trade - Sec, 7(a) (16) | Lender Advantage Initiative | Patriot Express | Revolving Line of Credit Exports - Sec. 7(a) (14) | Rural Lender Advantage | Seasonal Line of Credit | Small Asset Based | Small General Contractors - Sec. 7(a) (9) | Standard Asset Based | CORPORATION | INDIVIDUAL | PARTNERSHIP | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2006 | 11.25 | 84 | 1 | 4 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 1 | 2006 | 12.00 | 84 | 0 | 3 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 2 | 2006 | 12.00 | 84 | 0 | 4 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 3 | 2006 | 11.50 | 84 | 0 | 1 | 0.85 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 4 | 2006 | 11.50 | 84 | 0 | 1 | 0.85 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

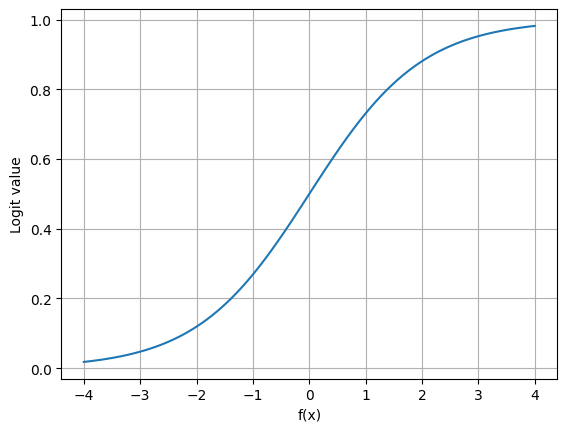

8.13. Logistic Regression (Logit)#

8.13.1. Limited Dependent Variables#

The dependent variable may be discrete, and could be binomial or multinomial. That is, the dependent variable is limited. In such cases, we need a different approach.

Discrete dependent variables are a special case of limited dependent variables. The Logit model we look at here is a discrete dependent variable model. Such models are also often called qualitative response (QR) models.

8.14. The Logistic Function#

where

#Sigmoid Function

def logit(fx):

return np.exp(fx)/(1+np.exp(fx))

fx = np.linspace(-4,4,100)

y = logit(fx)

plt.plot(fx,y)

plt.xlabel('f(x)')

plt.ylabel('Logit value')

plt.grid()

#Dependent categorical variable

y = pd.get_dummies(sba.LoanStatus, dtype=int)

y.head()

| CANCLD | CHGOFF | EXEMPT | PIF | |

|---|---|---|---|---|

| 0 | 1 | 0 | 0 | 0 |

| 1 | 1 | 0 | 0 | 0 |

| 2 | 1 | 0 | 0 | 0 |

| 3 | 0 | 0 | 0 | 1 |

| 4 | 1 | 0 | 0 | 0 |

#Prepare the X and y variables for chargeoffs vs paid in full

idx1 = list(np.where(y.CHGOFF==1)[0])

idx2 = list(np.where(y.PIF==1)[0])

idx = np.append(idx1,idx2)

print(len(idx))

X = X.iloc[idx]

# X["Intercept"] = 1.0

y = y.CHGOFF.iloc[idx]

#Save for later

y_SBA = y.copy()

X_SBA = X.copy()

223647

y_SBA

| CHGOFF | |

|---|---|

| 5 | 1 |

| 8 | 1 |

| 9 | 1 |

| 11 | 1 |

| 14 | 1 |

| ... | ... |

| 508757 | 0 |

| 510524 | 0 |

| 510828 | 0 |

| 511814 | 0 |

| 514919 | 0 |

223647 rows × 1 columns

X_SBA

| ApprovalFiscalYear | InitialInterestRate | TermInMonths | RevolverStatus | JobsSupported | GuaranteePct | 509 - DEALER FLOOR PLAN | Community Advantage Initiative | Community Express | Contract Guaranty | EXPORT IMPORT HARMONIZATION | FA$TRK (Small Loan Express) | Guaranty | Gulf Opportunity | International Trade - Sec, 7(a) (16) | Lender Advantage Initiative | Patriot Express | Revolving Line of Credit Exports - Sec. 7(a) (14) | Rural Lender Advantage | Seasonal Line of Credit | Small Asset Based | Small General Contractors - Sec. 7(a) (9) | Standard Asset Based | CORPORATION | INDIVIDUAL | PARTNERSHIP | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 5 | 2006 | 11.50 | 28 | 0 | 2 | 0.85 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 8 | 2006 | 11.25 | 46 | 1 | 6 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 9 | 2006 | 13.25 | 18 | 0 | 7 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 11 | 2006 | 12.25 | 32 | 0 | 2 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 14 | 2006 | 13.25 | 68 | 0 | 1 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 508757 | 2015 | 5.00 | 12 | 1 | 5 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 510524 | 2015 | 5.50 | 6 | 0 | 0 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 510828 | 2015 | 6.00 | 60 | 0 | 12 | 0.85 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 511814 | 2015 | 5.21 | 84 | 0 | 4 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 514919 | 2015 | 8.75 | 84 | 1 | 0 | 0.50 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

223647 rows × 26 columns

%%time

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import train_test_split

from sklearn.metrics import accuracy_score, roc_auc_score, confusion_matrix, classification_report

from sklearn.model_selection import cross_val_score

# instantiate a logistic regression model, and fit with X and y

model = LogisticRegression(penalty=None, max_iter=1000, tol=0.001) # higher number of iterations needed if the convergence rate is slow

model = model.fit(X, y)

# check the accuracy on the training set

model.score(X, y)

CPU times: user 1min 41s, sys: 331 ms, total: 1min 42s

Wall time: 1min 3s

/usr/local/lib/python3.12/dist-packages/sklearn/linear_model/_logistic.py:465: ConvergenceWarning: lbfgs failed to converge (status=1):

STOP: TOTAL NO. OF ITERATIONS REACHED LIMIT.

Increase the number of iterations (max_iter) or scale the data as shown in:

https://scikit-learn.org/stable/modules/preprocessing.html

Please also refer to the documentation for alternative solver options:

https://scikit-learn.org/stable/modules/linear_model.html#logistic-regression

n_iter_i = _check_optimize_result(

0.8281175244917214

#Show the coefficients

pd.DataFrame({'X':X.columns, 'Coeff':model.coef_[0]})

| X | Coeff | |

|---|---|---|

| 0 | ApprovalFiscalYear | -0.000785 |

| 1 | InitialInterestRate | 0.340614 |

| 2 | TermInMonths | -0.043086 |

| 3 | RevolverStatus | -0.372911 |

| 4 | JobsSupported | -0.000131 |

| 5 | GuaranteePct | -0.147432 |

| 6 | 509 - DEALER FLOOR PLAN | -0.054297 |

| 7 | Community Advantage Initiative | -0.008525 |

| 8 | Community Express | 1.519302 |

| 9 | Contract Guaranty | -0.306267 |

| 10 | EXPORT IMPORT HARMONIZATION | -0.027176 |

| 11 | FA$TRK (Small Loan Express) | -0.066487 |

| 12 | Guaranty | 1.621458 |

| 13 | Gulf Opportunity | -1.235105 |

| 14 | International Trade - Sec, 7(a) (16) | -0.009399 |

| 15 | Lender Advantage Initiative | -0.476701 |

| 16 | Patriot Express | 1.528784 |

| 17 | Revolving Line of Credit Exports - Sec. 7(a) (14) | -1.668423 |

| 18 | Rural Lender Advantage | -0.064062 |

| 19 | Seasonal Line of Credit | -0.048712 |

| 20 | Small Asset Based | -0.037235 |

| 21 | Small General Contractors - Sec. 7(a) (9) | -0.133957 |

| 22 | Standard Asset Based | -0.503938 |

| 23 | CORPORATION | 0.156950 |

| 24 | INDIVIDUAL | 0.177251 |

| 25 | PARTNERSHIP | -0.303480 |

8.15. Training, validation, and testing data: Underfitting, Overfitting, Cross-Validation#

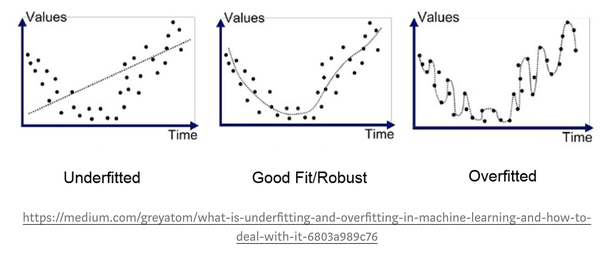

As we will see below, we split our data sample into training and testing subsets. Training data is used for machine learning a model and then the same model is applied to the test data (out-of-sample) to make sure the model performs well on data it has not already seen. The same model is also applied back to the same data on which it was trained. So, we get two accuracy scores, one on the training data set and another for the test data set. One hopes that a model performs as accurately on the test data as it does on the training data.

When accuracy is low on the training data, the model “underfits” the data. However, it may show a very high level of accuracy on the training data. This is a good thing, unless it achieves a very low accuracy level on the test data. In this case, we say that the model is “overfitted” to the data. The model is too specifically attuned to the training data so that it is useless for data outside the training data set. This occurs when the model has too many free parameters so it almost “memorizes” the training data set, which explains why it performs poorly on data it has not seen before. An analogy to this occurs when students memorize math homework problems without understanding the underlying concepts. When faced with a slightly different problem on the exam, they fail miserably.

We often break down a data sample into 3 types of data: training, validation, and testing data. Say we keep 20% of our data aside for testing. This is also known as “holdout” data. Of the remaining 80% data we may randomly sample 75% of it, and train the model so that it performs well on the remaining 25%. Then we randomly sample a different 75% and train to fit the remaining 25% starting from the current model or afresh. This is also called “rotation sampling”. If we repeat this \(n\) times to get the best model, we are said to undertake “\(n\)-fold cross-validation”. The results are averaged to assess fit. Once a model has been trained through this cross-validated process, it is then taken to the test data to assess how well it performs and determination is made as to the extent of overfitting, if any.

The figure below provides a visual depiction of under- and over-fitting.

# Evaluate the model by splitting into train and test sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=0)

model2 = LogisticRegression(penalty=None, max_iter=1000, tol=0.001)

model2.fit(X_train, y_train)

LogisticRegression(max_iter=1000, penalty=None, tol=0.001)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

LogisticRegression(max_iter=1000, penalty=None, tol=0.001)

# Predict class labels for the test set

predicted = model2.predict(X_test)

print(predicted)

[0 0 0 ... 1 1 1]

# Generate class probabilities

probs = model2.predict_proba(X_test)

print(probs)

[[0.93025884 0.06974116]

[0.95258196 0.04741804]

[0.83374884 0.16625116]

...

[0.29915793 0.70084207]

[0.41565239 0.58434761]

[0.22631199 0.77368801]]

model2.score(X_test, y_test)

0.8289589388180938

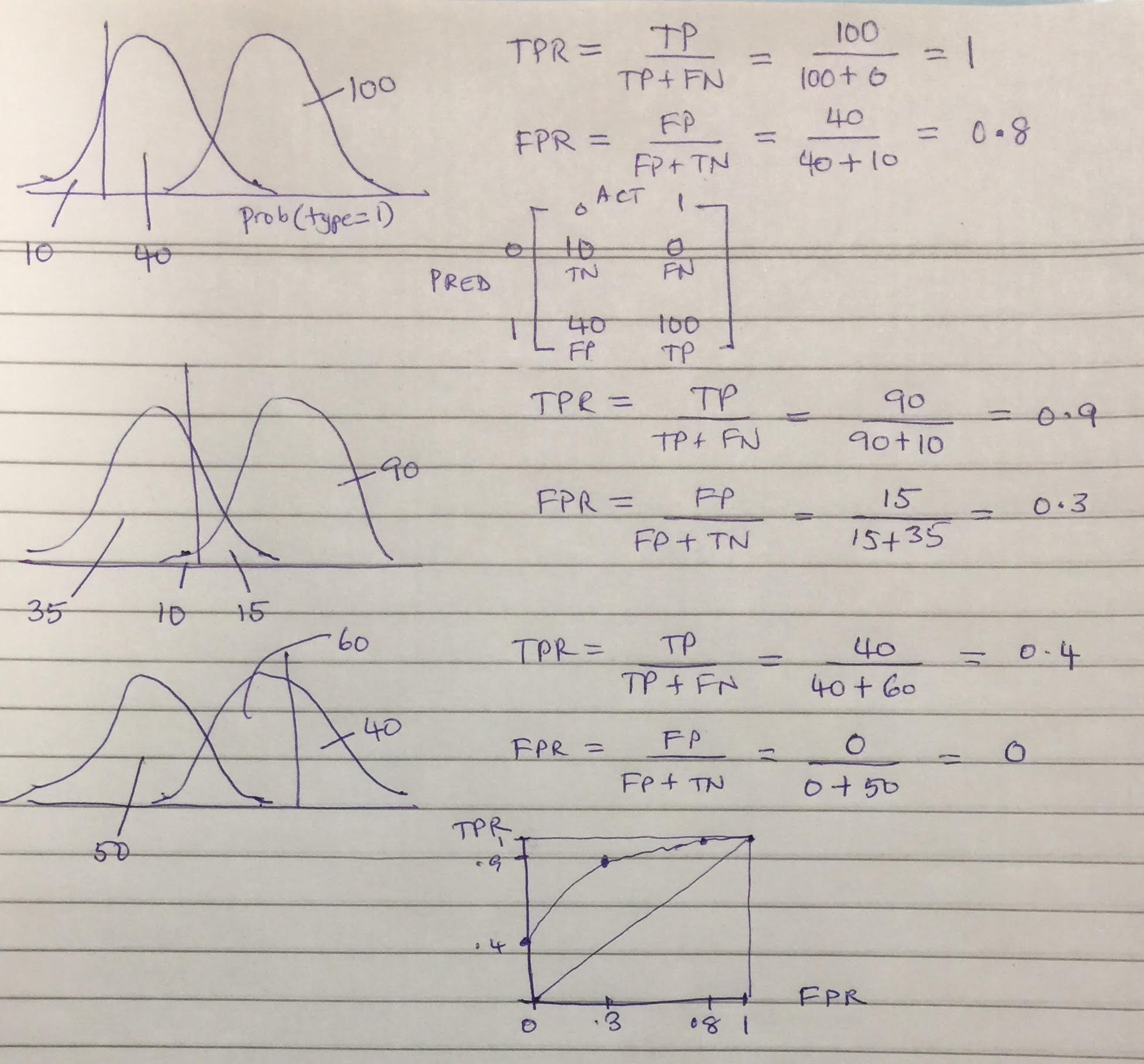

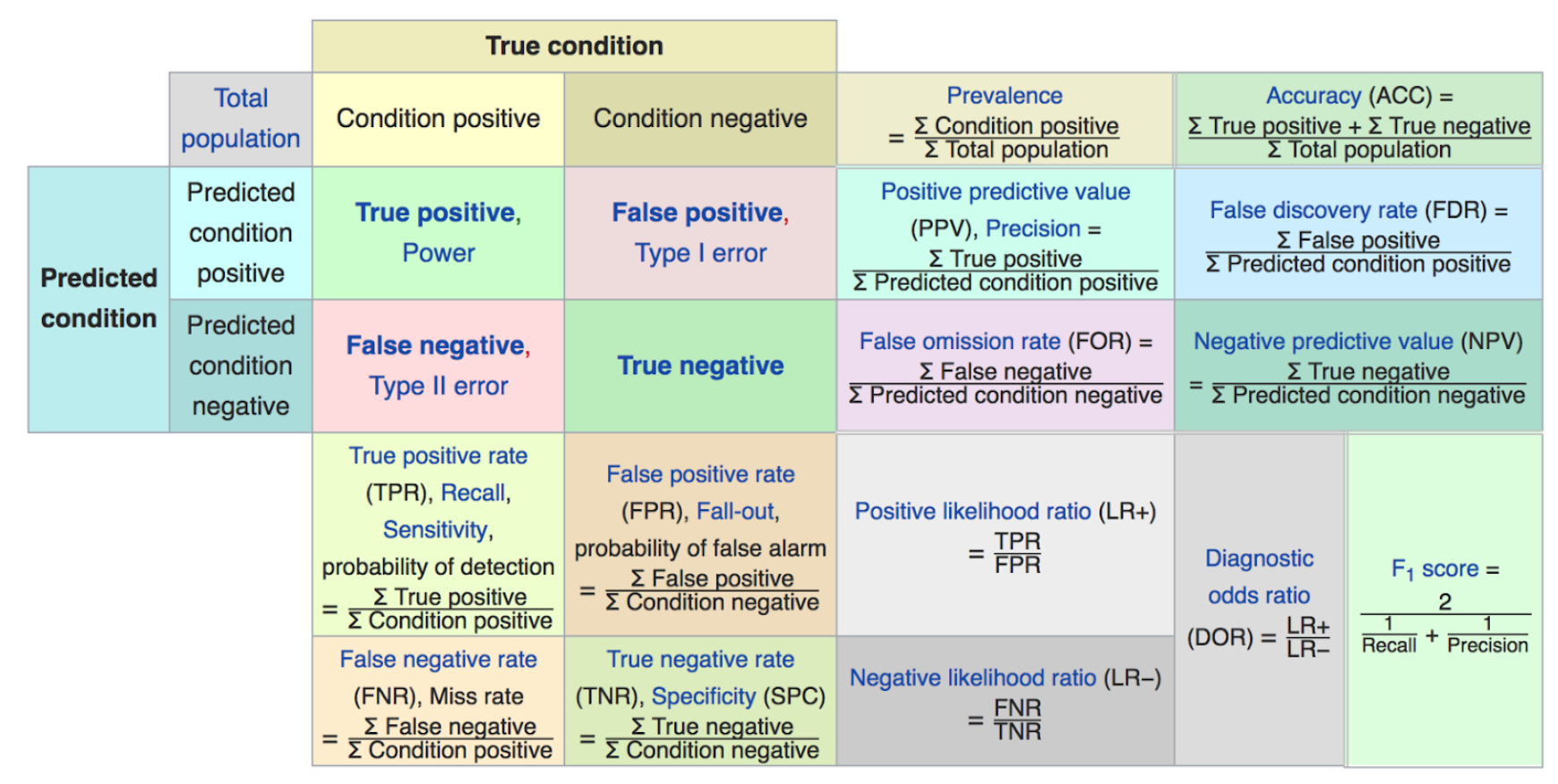

8.16. Metrics#

Accuracy: the number of correctly predicted class values.

TPR = sensitivity or recall = TP/(TP+FN)

FPR = (1 − specificity) = FP/(FP+TN)

# Confusion Matrix

CM = confusion_matrix(predicted, y_test) # predicted values on rows, true values on columns

CM

array([[43703, 7991],

[ 3485, 11916]])

8.17. More Metrics#

Precision = \(\frac{TP}{TP+FP}\)

Recall = \(\frac{TP}{TP+FN}\)

F1 score = \(\frac{2}{\frac{1}{Precision} + \frac{1}{Recall}}\)

(F1 is the harmonic mean of precision and recall.)

print(classification_report(predicted, y_test))

precision recall f1-score support

0 0.93 0.85 0.88 51694

1 0.60 0.77 0.67 15401

accuracy 0.83 67095

macro avg 0.76 0.81 0.78 67095

weighted avg 0.85 0.83 0.84 67095

8.18. The Matthews Correlation Coefficient#

https://en.wikipedia.org/wiki/Matthews_correlation_coefficient

This is a useful classification metric that is not widely used. See: https://towardsdatascience.com/the-best-classification-metric-youve-never-heard-of-the-matthews-correlation-coefficient-3bf50a2f3e9a

def MCC(tp,tn,fp,fn):

return (tp*tn - fp*fn)/np.sqrt((tp+fp)*(tp+fn)*(tn+fp)*(tn+fn))

Let’s take the confusion matrix from above and apply the numbers therein to compute MCC.

print(CM)

mcc = MCC(CM[1,1], CM[0,0], CM[0,1], CM[1,0])

print("MCC =", mcc)

[[43703 7991]

[ 3485 11916]]

MCC = 0.5699804607095624

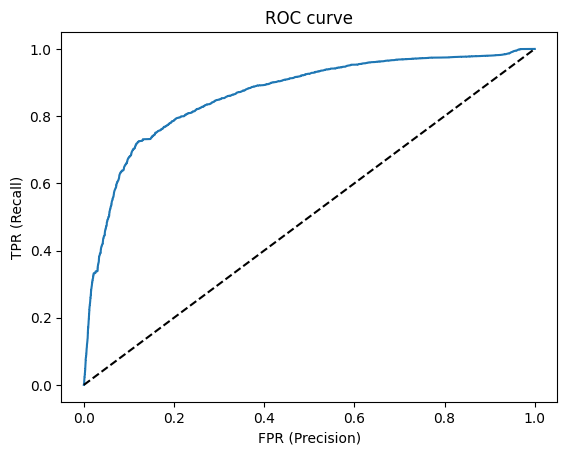

8.19. ROC and AUC#

The Receiver-Operating Characteristic (ROC) curve is a plot of the True Positive Rate (TPR) against the False Positive Rate (FPR) for different levels of the cut-off posterior probability. This is an essential trade-off in all classification systems.

# generate evaluation metrics

print('Accuracy =', accuracy_score(y_test, predicted))

print('AUC =', roc_auc_score(y_test, probs[:, 1]))

Accuracy = 0.8289589388180938

AUC = 0.8634186497943588

#ROC, AUC

from sklearn.metrics import roc_curve, auc

y_score = model.predict_proba(X_test)[:,1]

fpr, tpr, _ = roc_curve(y_test, y_score)

plt.title('ROC curve')

plt.xlabel('FPR (Precision)')

plt.ylabel('TPR (Recall)')

plt.plot(fpr,tpr)

plt.plot((0,1), ls='dashed',color='black')

plt.show()

print('Area under curve (AUC): ', auc(fpr,tpr))

Area under curve (AUC): 0.863236455638921

8.20. All In One#

A terrific article in Scientific American on ROC Curves by Swets, Dawes, Monahan (2000); pdf. And Dawes (1979) on the use of “Improper Linear Models”.

https://en.wikipedia.org/wiki/Receiver_operating_characteristic

8.21. ML Comic#

Google has put out an interesting comic book introduction to Machine Learning; pdf.

For a visual understanding of many ML concepts, Amazon has created https://www.amazon.science/latest-news/amazon-machine-learning-university-new-courses-mlu-explains